Welcome to your comprehensive guide on securing a condo mortgage in Panama City Beach, Florida! As a travel enthusiast and someone who’s spent many a sun-soaked day on the beautiful beaches here, I can tell you that owning a piece of this paradise is a dream that many share. Whether you’re looking for a vacation home or an investment property, navigating the mortgage landscape will be a key part of the journey. In this guide, we’ll delve into everything from the mortgage process and rates to travel tips for your time in Panama City Beach.

Understanding Condo Mortgages

A condo mortgage allows you to finance the purchase of a condominium unit. Unlike traditional homes, condos often come with homeowners association (HOA) fees and different regulations that can impact your loan process. Let’s explore the various types of mortgages available for condos and what you need to know to make an informed decision.

Types of Condo Mortgages

- Conventional Mortgages: These loans are not insured or guaranteed by the government and typically require higher credit scores and down payments.

- FHA Loans: Backed by the Federal Housing Administration, these loans are great for first-time buyers and require lower down payments, but come with specific condo eligibility criteria.

- VA Loans: If you’re a veteran, you may qualify for these loans, which do not require down payments and have favorable terms.

- USDA Loans: For those looking at condos in rural areas, USDA loans offer an affordable option with no down payment.

Key Considerations for Condo Mortgages

Before embarking on your financing journey, consider the following:

- Location and Amenities: The more desirable the location and amenities, the easier it will be to find financing.

- HOA Fees: High fees can affect your debt-to-income ratio, impacting your mortgage eligibility.

- Condo Association’s Financial Health: Lenders will look into the financial stability of the condo association.

Navigating the Condo Mortgage Application Process

Securing a mortgage for your dream condo can be straightforward if you’re prepared. Here’s a step-by-step approach to guide you through the application process.

1. Assess Your Finances

Evaluate your credit score, income, and existing debts to understand your financial standing. This will help you determine what kind of mortgage you can afford.

2. Get Pre-Approved

Before you start condo hunting, getting pre-approved for a mortgage gives you a realistic budget and shows sellers you are a serious buyer.

3. Choose the Right Lender

Compare lenders to find the best rates and terms. Look out for any additional fees and the lender’s experience with condo financing.

4. Make an Offer

Once you find the perfect condo, work with your real estate agent to make a competitive offer.

5. Undergo the Appraisal and Inspection

Your lender will require an appraisal to ensure the condo’s value and an inspection to assess its condition.

6. Close the Deal

Review all paperwork carefully, and once everything is in place, finalize your mortgage loan.

Comparing Mortgage Options: A Table of Rates

| Type of Loan | Avg. Interest Rate | Down Payment | Loan Term |

|---|---|---|---|

| Conventional | 4.5% | 20% | 15-30 years |

| FHA | 3.75% | 3.5% | 15-30 years |

| VA | 3.5% | 0% | 15-30 years |

| USDA | 3.75% | 0% | 30 years |

Travel Experiences in Panama City Beach

As someone who has explored Panama City Beach extensively, I can tell you that the area is much more than just a beautiful coastline. The local culture, vibrant nightlife, and outdoor activities make it a fantastic destination. Let me share some personal experiences that showcase the charm of this coastal city.

Beaches and Outdoor Activities

One of my favorite days in Panama City Beach started with an early morning stroll along the shoreline. The soft, white sand and clear blue waters were mesmerizing. I rented paddleboards from a local shop, which is a fun way to explore the Gulf waters while getting some exercise. The sunsets here are out of this world, often painting the sky in shades of orange and pink while I sat on my balcony, cocktail in hand.

Dining and Nightlife

After a full day of sun and surf, nothing beats indulging in fresh seafood. I highly recommend Captain Anderson’s for a delicious crab dish, followed by a stop at PCB’s famous beach bars for live music and dancing. The atmosphere is always lively, and the locals make you feel right at home.

Destination Highlights of Panama City Beach

- St. Andrews State Park: A must-visit for nature lovers, this park offers pristine beaches, hiking trails, and excellent fishing spots.

- Pier Park: A shopping and entertainment hub where you can find everything from chic boutiques to movie theaters.

- Gulf World Marine Park: Perfect for a family day out, this marine park has exhibits featuring dolphins, sea lions, and more.

Pros and Cons of Buying a Condo in Panama City Beach

Pros

- Stunning Views: Many condos offer breathtaking views of the Gulf.

- Low Maintenance: Condos typically require less maintenance than single-family homes.

- Investment Potential: Rental demand is high in tourist seasons, making it a potentially profitable investment.

Cons

- HOA Fees: Monthly fees can add to your expenses.

- Less Privacy: Shared spaces may not appeal to everyone.

- Market Volatility: Real estate markets can fluctuate, affecting property values.

FAQs about Panama City Beach Condo Mortgages

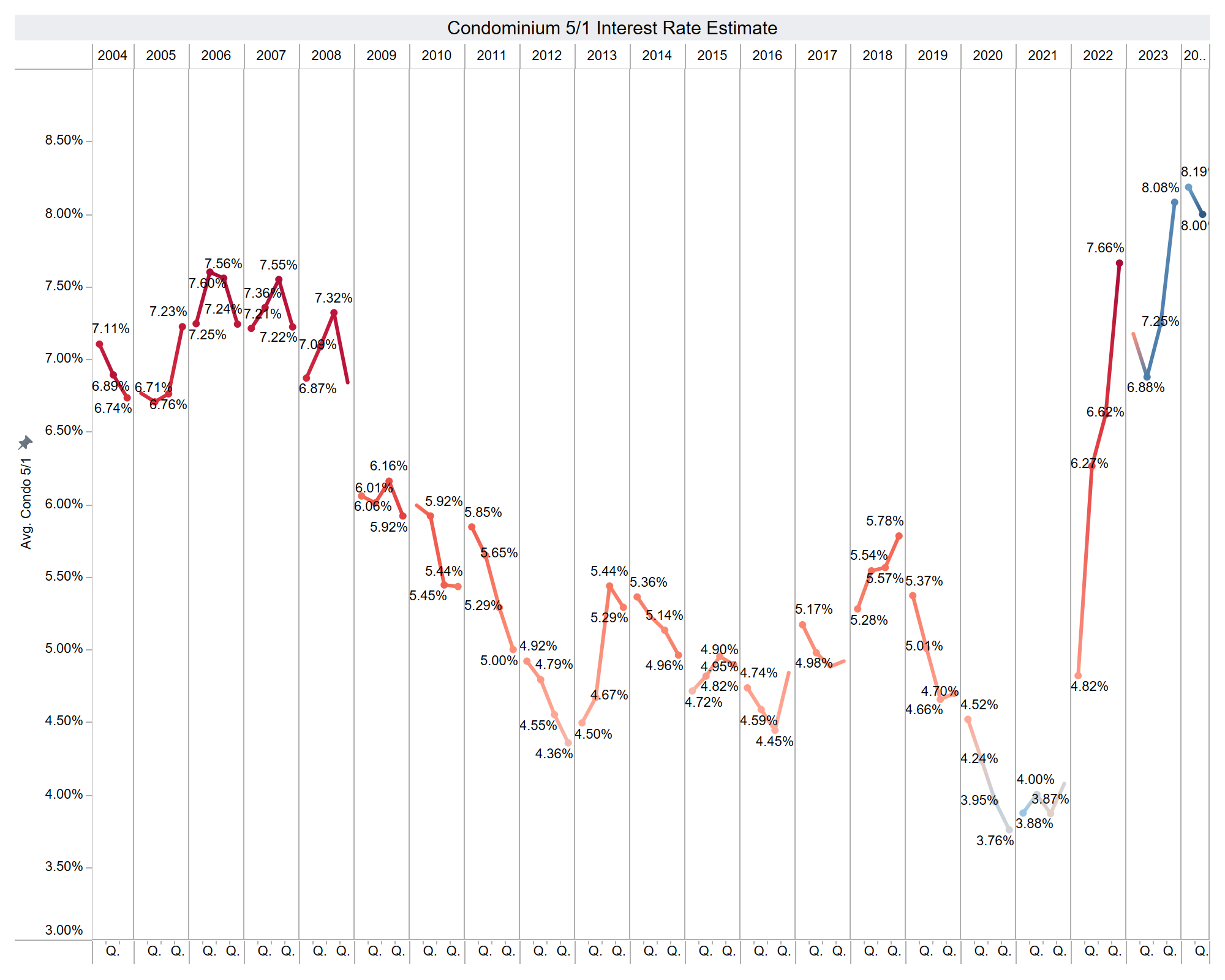

1. What is the average mortgage rate for condos in Panama City Beach?

The average mortgage rate for condos in Panama City Beach typically ranges from 3.5% to 4.5% based on the type of loan and market conditions.

2. Do I need a higher down payment for a condo mortgage?

While conventional loans often require a higher down payment (20%), FHA loans offer lower down payment options of just 3.5%.

3. Are there specific FHA requirements for condos?

Yes, not all condos are eligible for FHA loans. They must be on the FHA’s approved list, and the condo association must meet certain criteria.

4. Can I rent out my condo in Panama City Beach?

Yes! Many owners rent their condos, especially during peak tourist seasons. Just ensure you check the HOA regulations regarding short-term rentals.

5. What should I consider when choosing a lender for my condo mortgage?

Look for lenders with experience in condo financing, favorable rates, customer service reviews, and reasonable fees.

Travel Tips for Panama City Beach

- Best Time to Visit: The best time to visit is during the shoulder seasons (spring and fall) when the weather is pleasant, and the crowds are smaller.

- Pack Smart: Don’t forget sunscreen, swimwear, and comfortable shoes for walking on the beach and exploring local attractions.

- Local Events: Check out local events and festivals for an authentic local experience.

Conclusion

Owning a condo in Panama City Beach can be an incredibly fulfilling experience, both as a vacation spot and an investment. With the right mortgage knowledge, financing options, and a bit of personal exploration, you can make the most of this beautiful slice of Florida. Whether it’s the stunning beaches, vibrant nightlife, or the thrill of purchasing your property, you’re bound to create lasting memories. Here’s to your future in Panama City Beach!