Introduction

Traveling to Long Beach, California, is an adventure filled with sun, sea, and unique experiences. But as a savvy traveler, understanding the local sales tax rate is essential for budgeting your trip. This comprehensive guide will dive deep into the sales tax implications in Long Beach, how they affect your purchases, and offer some personal travel insights to make your visit even more enjoyable.

What is Sales Tax?

Sales tax is a consumption tax imposed by governments on the sale of goods and services. In Long Beach, as part of California, the sales tax rate comprises state, county, and local taxes, which can significantly impact your overall expenses while traveling.

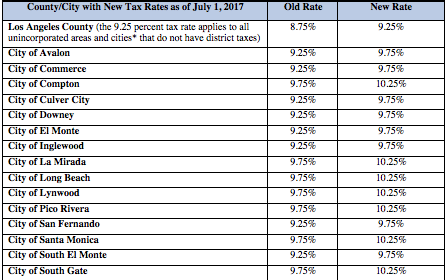

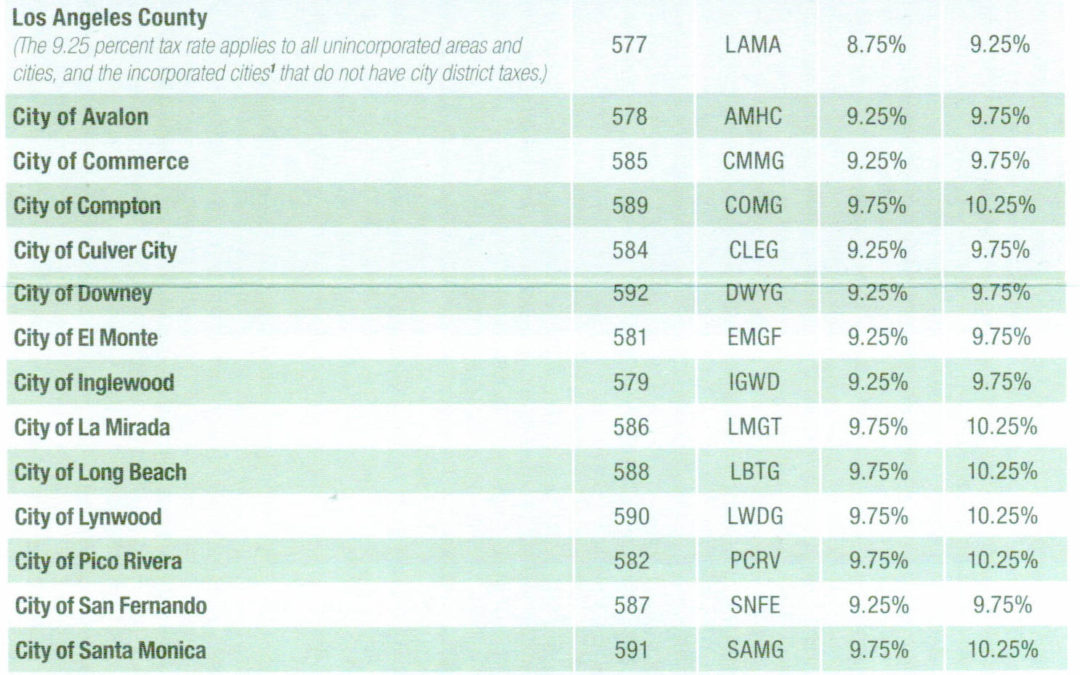

Current Sales Tax Rate in Long Beach, CA

As of October 2023, the total sales tax rate in Long Beach, California, is 10.25%. This includes:

- State Sales Tax: 7.25%

- Los Angeles County Sales Tax: 2.0%

- City of Long Beach Sales Tax: 1.0%

This combination makes shopping and dining slightly more pricey than in some other regions, but the vibrant experiences are worth it!

Understanding How Sales Tax Affects Travelers

Why Travelers Should Care

As a traveler, knowing the sales tax rate can help you plan your budget better. Whether it’s dining out, shopping for souvenirs, or renting equipment for outdoor activities, the sales tax adds a percentage to your final bill.

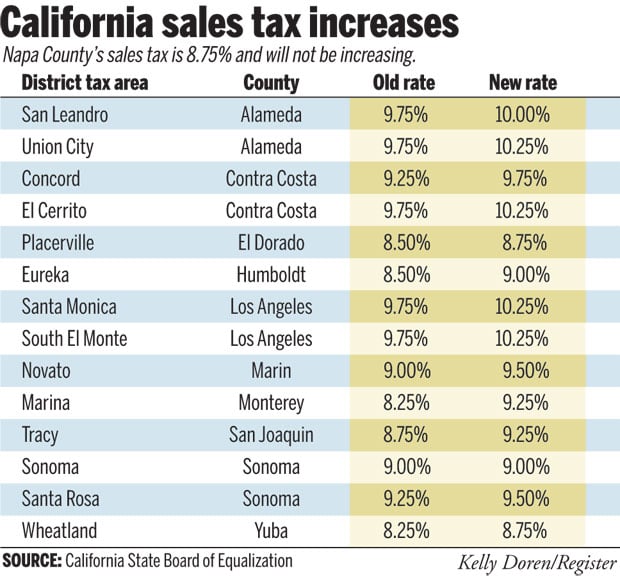

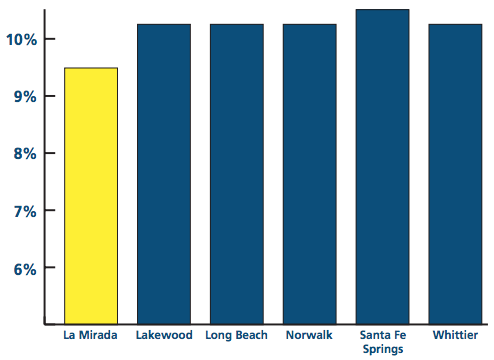

Comparison of Sales Tax Rates

| City | Sales Tax Rate |

|---|---|

| Long Beach, CA | 10.25% |

| Los Angeles, CA | 10.25% |

| San Diego, CA | 7.75% |

| San Francisco, CA | 8.5% |

| Seattle, WA | 10.1% |

As you can see, Long Beach shares the same sales tax rate as Los Angeles, making it essential to factor this into your spending plans.

Travel Expenses: Planning for Sales Tax

Budgeting for Food and Dining

When dining out in Long Beach, the sales tax can add up quickly. For example, if you enjoy a meal that costs $50, you should anticipate an additional $5.13 for sales tax. Here’s a quick calculation of potential dining expenses:

| Meal Cost | Sales Tax (10.25%) | Total Cost |

|---|---|---|

| $20 | $2.05 | $22.05 |

| $50 | $5.13 | $55.13 |

| $100 | $10.25 | $110.25 |

Shopping and Souvenirs

Shopping in Long Beach can be a delightful experience, filled with unique local shops and boutiques. Keep in mind that the sales tax will apply here, too. If you plan to purchase souvenirs totaling $100, expect to pay $10.25 in sales tax. Here’s how it breaks down:

| Purchase Amount | Sales Tax (10.25%) | Total Amount |

|---|---|---|

| $50 | $5.13 | $55.13 |

| $100 | $10.25 | $110.25 |

| $200 | $20.50 | $220.50 |

Pros and Cons of Sales Tax in Long Beach

Pros

- Provides funding for essential services like education, public safety, and infrastructure.

- Helps maintain Long Beach as a vibrant city with numerous attractions and amenities.

- Encourages tourism by showcasing local businesses and the economy.

Cons

- Can increase the cost of living and visiting Long Beach compared to other cities.

- Can be confusing for travelers unfamiliar with tax rates.

- May deter some travelers who are budget-conscious.

Tips for Traveling to Long Beach

1. Be Aware of Prices

Always consider the sales tax when planning your budget. It helps to mentally add around 10% to the listed prices for food, shopping, and services.

2. Look for Tax-Free Days

Occasionally, local festivals or events might feature tax-free shopping days. Be on the lookout for these special offers, which can help you save.

3. Use Cash When Possible

Using cash ensures you know exactly what you’re spending, without the risk of overspending on your credit card.

4. Enjoy Local Markets

Local farmers’ markets often have items that might not be taxed in the same way as retail goods, giving you a budget-friendly option.

Destination Highlights in Long Beach

Explore the Queen Mary

The famous Queen Mary, a retired ocean liner, is a must-visit. You can tour its historical rooms and even enjoy dining options onboard without the rush of sales tax affecting your enjoyment!

Relax at the Beach

The beaches in Long Beach are beautiful, and beach access is free! Just keep your other expenses in mind while planning your day in the sun.

Visit the Aquarium of the Pacific

This engaging aquarium offers fun experiences for all ages, and while the ticket price includes sales tax, the experience is well worth it!

FAQs about Sales Tax in Long Beach, CA

What is the sales tax rate in Long Beach?

The sales tax rate in Long Beach, CA, is currently 10.25%.

Are food and drinks taxed in Long Beach?

Yes, food and drinks are subject to the sales tax unless purchased from specific tax-exempt sources, like certain grocery stores.

Does sales tax apply to online purchases from Long Beach?

Yes, if you’re purchasing from a retailer in California or are using a delivery service to have goods shipped to Long Beach, sales tax typically applies.

Are there any exemptions to sales tax in Long Beach?

Certain items like prescription medications, some food products, and services may be exempt from sales tax. It’s best to check local regulations for specifics.