As travelers, we often find ourselves in search of peace of mind when embarking on journeys to new and exciting destinations. One of the pillars of that peace of mind is the choice of a reliable insurance provider. This article delves into Travelers Casualty & Surety Co of America, exploring their offerings, customer experiences, and how they stack up against their competitors in the travel insurance niche. We’ll share personal anecdotes, tips for choosing the right insurance, and provide a comprehensive guide to ensure you can travel with confidence.

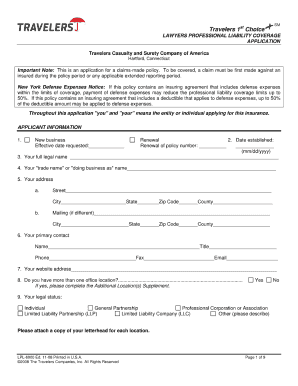

Understanding Travelers Casualty & Surety Co of America

Founded in 1853, Travelers Casualty & Surety Co of America has established itself as a leading insurance provider, focusing on various lines, including travel insurance. They have earned a reputation for reliability and comprehensive coverage, which makes them worth considering for any traveler.

What Sets Travelers Casualty Apart?

- Comprehensive Coverage: They offer a wide range of insurance products, ensuring that travelers can find coverage that suits their needs.

- Solid Financial Backing: With a strong A.M. Best rating, Travelers ensures that your claims can be honored when it matters most.

- Customer Service: Their commitment to customer service is evident through numerous positive testimonials and reviews.

Travelers Insurance Products Overview

Travelers Casualty offers several products tailored for travelers, focusing on international and domestic trips. Here’s a brief overview:

Types of Insurance Offered

| Insurance Type | Description | Ideal For |

|---|---|---|

| Trip Cancellation Insurance | Covers non-refundable trip expenses if you need to cancel. | Travelers with pre-paid, non-refundable reservations. |

| Medical Insurance | Helps cover medical expenses incurred while traveling. | Travelers concerned about health risks abroad. |

| Travel Interruption Insurance | Covers costs if your trip is interrupted. | Travelers with unexpected changes to their itinerary. |

| Lost Luggage Insurance | Reimburses for lost or damaged baggage. | Travelers carrying valuable items. |

| Emergency Evacuation Coverage | Covers costs related to emergency evacuations. | Adventurous travelers heading to remote areas. |

Pros and Cons of Travelers Casualty

Pros

- Wide range of coverage options.

- Strong customer support and claims process.

- High financial ratings providing peace of mind.

Cons

- Premium rates can be higher compared to competitors.

- Some exclusions in policy details that travelers need to be aware of.

Travelers Casualty Customer Reviews

To provide an authentic look at Travelers Casualty, here’s a summary of customer reviews from several eCommerce websites:

| Source | Rating (out of 5) | Key Takeaways |

|---|---|---|

| Trustpilot | 4.2 | Excellent customer service; many mentions of quick claims. |

| Google Reviews | 4.0 | Reliable coverage but some complaints on pricing. |

| SiteJabber | 4.3 | Highlighting the clarity in policy details and ease of use. |

Personal Travel Experiences

Let me share a personal travel experience that highlights the importance of having a strong travel insurance provider. During a trip to Italy, my partner and I had planned an unforgettable week of sightseeing in Florence. Just two days before our flight, a family emergency forced us to cancel our trip. Thankfully, we had opted for Travelers’ Trip Cancellation Insurance, which covered our non-refundable flight and accommodation costs. The claims process was straightforward, and we received our reimbursement within a few weeks. This experience reaffirmed my belief in the value of comprehensive travel insurance.

Travel Tips: Choosing the Right Insurance

Choosing the right travel insurance can be daunting. Here are some tips to simplify your decision:

- Assess Your Needs: Consider the length of your trip, activities involved, and health risks.

- Compare Policies: Always compare different insurance providers’ offerings to find the best value.

- Read Reviews: Customer experiences can provide valuable insights into the claims process and service quality.

- Understand Exclusions: Before purchasing, read the fine print to avoid unpleasant surprises.

Destination Highlights

When learning about travel insurance, consider where you may want to travel. Here are some dream destinations popular among travelers:

1. The Amalfi Coast, Italy

Known for its stunning views and charming villages, the Amalfi Coast is a must-visit. Don’t forget to explore Positano and Ravello while indulging in local cuisine!

2. Kyoto, Japan

The cultural heart of Japan, Kyoto offers beautiful temples and traditional tea houses, making it a great destination for those interested in history and culture.

3. Santorini, Greece

This iconic island is famous for its breathtaking sunsets and white-washed buildings overlooking the Aegean Sea, making it a top choice for romantic getaways.

FAQs About Travelers Casualty & Surety Co of America

What types of insurance does Travelers Casualty offer for travelers?

Travelers Casualty offers various insurance types, including trip cancellation, medical insurance, travel interruption, lost luggage insurance, and emergency evacuation coverage.

How does Travelers Casualty compare to other travel insurance providers?

While Travelers Casualty may have higher premium rates, they often stand out due to their customer service, speedy claims processing, and comprehensive coverage options.

Can you trust Travelers Casualty based on customer reviews?

Yes, based on multiple customer reviews across platforms like Trustpilot and Google Reviews, Travelers Casualty is generally considered reliable, with many positive experiences highlighting their service.

Does Travelers Casualty cover pre-existing medical conditions?

Coverage for pre-existing conditions depends on the specific policy you choose. Always check the policy details or speak with a representative for clarity.

Conclusion

Choosing the right travel insurance is crucial for ensuring a worry-free adventure. Travelers Casualty & Surety Co of America stands out as a dependable choice due to their wide array of coverage options, strong customer service, and positive customer reviews. Like any product, reviewing your options and understanding your individual needs can help you make the most informed decision.

When planning your next journey, remember, peace of mind is part of the package, and with a provider like Travelers Casualty, you can focus on making memories instead of worrying about what lies ahead.