As a travel enthusiast who has spent memorable moments in beautiful Virginia Beach, I understand the joy of exploring new destinations. But part of that adventure often involves finding the right place to call home, especially if you are looking to purchase property in this coastal paradise. In this comprehensive guide, we will delve into the best mortgage options available in Virginia Beach, ensuring that you have all the information you need to make informed decisions.

Why Choose Virginia Beach?

Virginia Beach is renowned for its stunning beaches, vibrant boardwalk, and lively atmosphere. Beyond its vacation appeal, it also offers a rich sense of community and various housing opportunities, making it a desirable place to live. Here are some highlights that make Virginia Beach a great choice:

- Beautiful natural landscapes and beach activities.

- A diverse range of neighborhoods, from bustling urban areas to quiet suburban streets.

- Cultural attractions such as art galleries, museums, and local events.

- Access to excellent schools and healthcare facilities.

The Mortgage Landscape in Virginia Beach

Understanding Mortgages

Before diving into the best mortgage options, it’s crucial to understand what a mortgage is. A mortgage is a loan used to purchase real estate, where the property serves as collateral. The borrower repays the loan over a specified period, typically 15 to 30 years, with interest. The two main components of a mortgage include:

- Principal: The actual amount borrowed.

- Interest: The cost of borrowing the principal amount.

Types of Mortgages Available in Virginia Beach

Virginia Beach offers various types of mortgages, each catering to different financial situations and preferences. Let’s explore some of the most common options:

1. Fixed-Rate Mortgages

Fixed-rate mortgages are the most straightforward type. Borrowers secure a fixed interest rate for the entire loan term, making monthly payments predictable. This option is ideal for those who plan to stay in Virginia Beach long-term.

2. Adjustable-Rate Mortgages (ARMs)

ARMs start with a lower initial interest rate for a set period but can fluctuate after that based on market conditions. If you anticipate selling or refinancing within a few years, this might be a cost-effective option.

3. FHA Loans

Federal Housing Administration (FHA) loans are ideal for first-time homebuyers with lower credit scores or limited funds for a down payment. These loans have more lenient credit requirements and allow for lower down payments, making homeownership accessible to more people.

4. VA Loans

Virginia Beach is home to numerous military families, and VA loans are specifically designed for veterans and active-duty service members. These loans often require no down payment and have competitive interest rates, providing significant savings.

5. USDA Loans

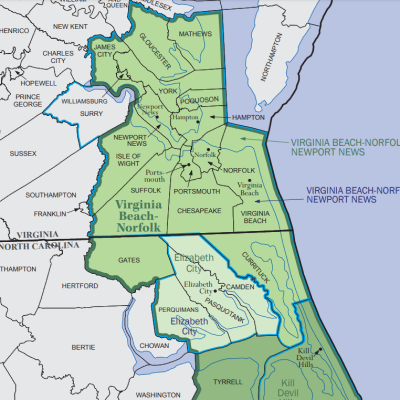

The United States Department of Agriculture (USDA) offers loans for rural homebuyers, including areas of Virginia Beach classified as rural. These loans typically require no down payment and are aimed at promoting homeownership in less populated areas.

Choosing the Right Mortgage: Key Considerations

When selecting a mortgage, consider the following factors:

1. Your Financial Situation

Assess your current financial status, including income, savings, and debts, to determine how much you can afford. A detailed budget will help you understand your spending capacity better.

2. Credit Score

Your credit score significantly affects the interest rates and terms you’re offered. Higher scores generally result in better mortgage rates. A good practice is checking your credit score before applying for a mortgage.

3. Loan Type

Determine which type of mortgage aligns best with your long-term goals and financial situation. Each type has its pros and cons, which we’ll explore further.

4. Down Payment

Most loans require a down payment, which can be a significant upfront cost. Traditional loans often require 20%, while FHA loans can go as low as 3.5%. Consider how much you can afford as a down payment to avoid additional insurance costs.

5. Loan Terms

Mortgages can have various terms, typically ranging from 15 to 30 years. A shorter term may have higher monthly payments but lower overall interest costs, while a longer term spreads payments over more years but increases total interest paid.

Comparison of Mortgage Options in Virginia Beach

| Mortgage Type | Down Payment | Credit Score Requirement | Interest Rate Type | Pros | Cons |

|---|---|---|---|---|---|

| Fixed-Rate Mortgage | 10% – 20% | 620+ | Fixed | Predictable payments | Higher interest rate than ARMs |

| Adjustable-Rate Mortgage | 10% – 20% | 620+ | Variable | Lower initial rate | Potential for increase |

| FHA Loan | 3.5% | 580+ | Fixed | Low down payment | Mortgage insurance required |

| VA Loan | 0% | No minimum | Fixed | No down payment, no PMI | Only for eligible veterans |

| USDA Loan | 0% | 640+ | Fixed | No down payment | Area restrictions apply |

Tips for Securing a Mortgage in Virginia Beach

Now that you’re familiar with the types of mortgages, here are some practical tips to secure the best deal:

1. Shop Around

Don’t settle for the first lender you find. Compare rates, terms, and fees from different lenders to ensure you secure the best mortgage deal. Consider local banks, credit unions, and online lenders.

2. Get Pre-Approved

Pre-approval gives you a clear idea of how much you can borrow and shows home sellers that you’re a serious buyer. This can give you an edge in competitive markets.

3. Negotiate Terms

Don’t hesitate to negotiate terms with lenders. You might be able to reduce closing costs or secure a lower interest rate, especially if you have good credit.

4. Maintain Good Credit

Improving your credit score before applying for a mortgage can significantly impact the terms you receive. Pay down debts and ensure timely payments on all accounts.

5. Understand the Closing Costs

Closing costs can add up, ranging from 2% to 5% of the loan amount. Be prepared for these costs and factor them into your overall budget.

Pros and Cons of Buying a Home in Virginia Beach

Pros

- Access to beautiful beaches and outdoor activities.

- Diverse real estate options to fit different lifestyles.

- Family-friendly environment with good schools.

- Rich cultural and historical attractions.

Cons

- Higher cost of living compared to other Virginia cities.

- Potential for hurricanes and flooding.

- Seasonal tourist influx can increase local congestion.

Personal Experience: The Joy of Finding a Home in Virginia Beach

During my travels in Virginia Beach, I had the pleasure of exploring its vibrant neighborhoods. I distinctly remember visiting the picturesque Oceanfront area, with its lively boardwalk and stunning views of the Atlantic. The sense of community here is palpable, and it’s no wonder many choose to settle down in this beautiful locale. When I helped a friend secure a mortgage in the area, we were delighted to discover a charming two-bedroom condo just a few blocks from the beach. The process was straightforward, but we had to navigate through various mortgage options carefully.

Frequently Asked Questions (FAQs)

What is the average mortgage rate in Virginia Beach?

As of 2023, the average mortgage rate in Virginia Beach typically ranges from 3% to 4%, depending on the type of loan and borrower qualifications. It’s always best to check with lenders for the most current rates.

How can I improve my chances of mortgage approval?

Improving your credit score, maintaining a stable income, paying down debts, and having a solid down payment can significantly enhance your chances of securing mortgage approval.

Are there first-time homebuyer programs in Virginia Beach?

Yes, Virginia Beach offers several first-time homebuyer programs that provide assistance with down payments, closing costs, and education about the home purchasing process.

Can I get a mortgage with bad credit in Virginia Beach?

While it can be challenging, certain loan types such as FHA loans may still be available to those with lower credit scores. It’s advisable to speak with a mortgage advisor to explore your options.

What is the best time to buy a house in Virginia Beach?

The best time to buy a house in Virginia Beach is often during the fall and winter months when competition is lower, and home prices may decrease. However, this can vary based on market conditions.

Conclusion

Finding the right mortgage in Virginia Beach is a crucial step towards enjoying all that this remarkable city has to offer. Whether you’re drawn by the beautiful coastline, the vibrant community, or the rich cultural scene, understanding your mortgage options will empower you to make the best choice. Remember to do your research, consult with professionals, and take your time in making this significant decision. Happy house hunting!

For more reliable information, consider checking sources like the U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of Veterans Affairs.