Travel insurance can provide peace of mind when you embark on your journeys. However, the world of travel insurance is not always smooth sailing. Recently, many travelers have voiced their concerns regarding Travel Guard Insurance, leading to a class action lawsuit. In this article, we’ll explore the ins and outs of Travel Guard Insurance, the class action lawsuit, and what you should consider before purchasing travel insurance for your next trip.

What is Travel Guard Insurance?

Travel Guard Insurance is a well-known provider of travel insurance products, offering various plans that cover trip cancellations, medical emergencies, lost luggage, and more. Their insurance policies aim to protect travelers from unexpected events that could derail their plans.

Types of Coverage Offered

- Trip Cancellation Insurance: Reimburses you for non-refundable costs if you have to cancel your trip.

- Travel Medical Insurance: Covers medical expenses in case of illness or injury while traveling.

- Lost Luggage Insurance: Offers compensation for lost or delayed luggage.

- Emergency Evacuation Insurance: Covers the costs of transporting you to a medical facility in case of emergencies.

The Class Action Lawsuit Explained

The class action lawsuit against Travel Guard Insurance revolves around claims made by customers who felt misled about the coverage provided. Many travelers reported that their claims were denied or not adequately covered, leading to financial and emotional distress.

Reasons for the Class Action

Some common grievances among travelers include:

- Miscommunication about policy limits and exclusions.

- Delayed claim processing times.

- Denied claims for valid reasons that should have been covered.

Personal Travel Experiences

As a frequent traveler, I once relied on travel insurance to cover a trip to Europe. Unfortunately, I faced a medical emergency that resulted in surgery. Thankfully, I had an insurance policy that covered the costs, but many horror stories circulate about travelers who weren’t as fortunate. These anecdotes underline the importance of choosing a reliable provider.

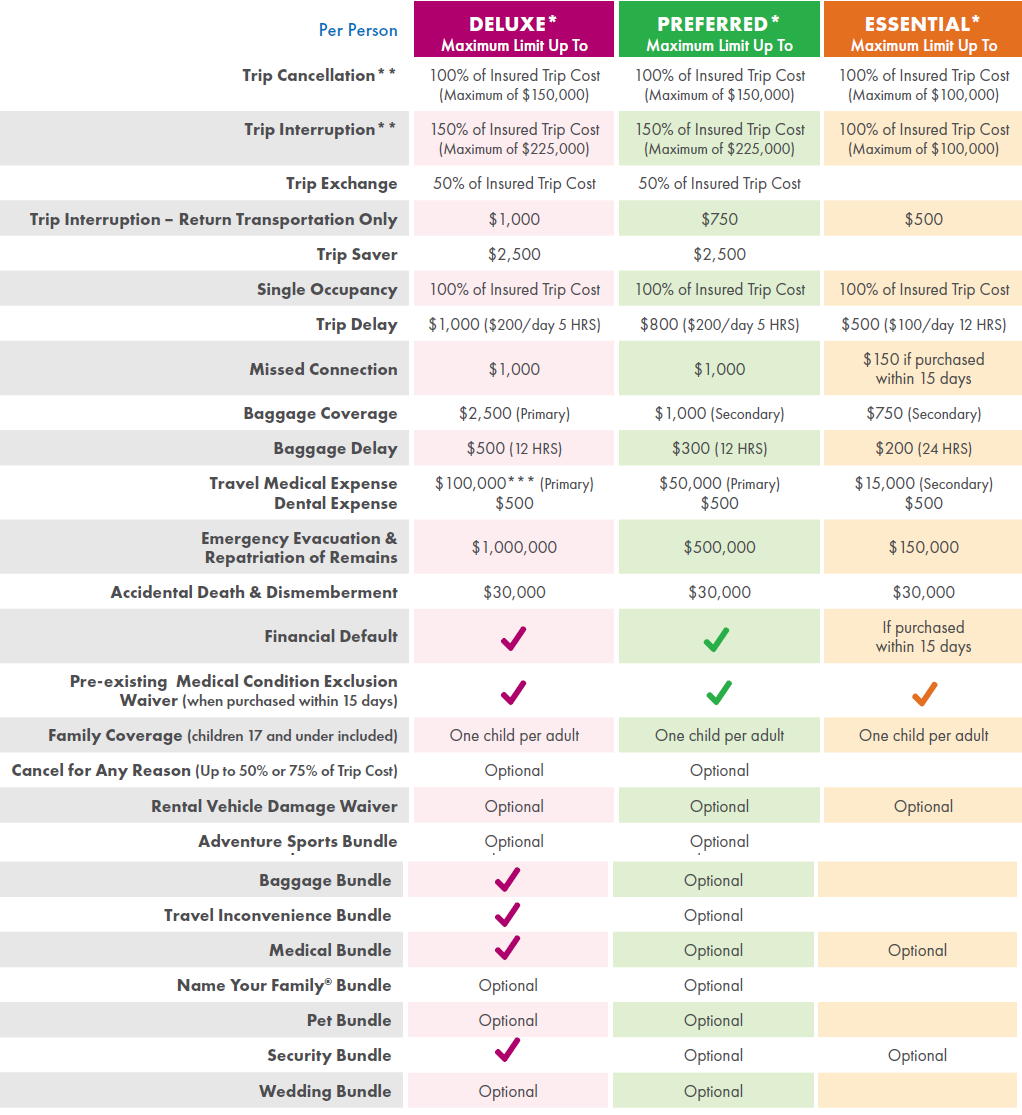

Comparing Travel Guard with Other Insurance Providers

When considering travel insurance, it’s essential to compare different providers to find the best fit for your needs. Below is a comparison of Travel Guard Insurance with two popular alternatives.

| Feature | Travel Guard Insurance | Allianz Travel Insurance | World Nomads |

|---|---|---|---|

| Trip Cancellation Coverage | Yes | Yes | Yes |

| Emergency Medical Coverage | Up to $500,000 | Up to $1,000,000 | Up to $100,000 |

| Lost Luggage Coverage | Yes | Yes | Yes |

| Pre-existing Conditions Coverage | Yes (with restrictions) | Yes (under certain conditions) | No |

| 24/7 Assistance | Yes | Yes | Yes |

Travel Insurance Tips

Before purchasing travel insurance, keep these tips in mind to ensure you make an informed decision:

1. Read the Fine Print

Understanding your policy’s terms and conditions is crucial. Look for exclusions and limitations that may affect your coverage.

2. Assess Your Needs

Evaluate what type of coverage you require based on your travel plans. Frequent travelers may want more comprehensive plans, while occasional travelers may opt for basic coverage.

3. Compare Multiple Providers

Don’t settle for the first policy you find. Use comparison tools to analyze different plans and their costs.

4. Check Customer Reviews

Research customer feedback to gauge the reliability and service quality of the insurance provider.

5. Keep Documents Handy

Always have your insurance policy and emergency contact information readily available while traveling.

Pros and Cons of Travel Guard Insurance

Pros

- Wide range of coverage options.

- 24/7 customer service assistance.

- Good reputation in the industry.

Cons

- Higher premium costs compared to some competitors.

- Claims can sometimes take longer to process.

- Recent negative press due to the class action lawsuit.

Destination Highlights with Travel Insurance

Traveling is about exploring new places, and having travel insurance can help ensure a smoother experience. Here are a few must-visit destinations and how travel insurance can be beneficial:

1. Bali, Indonesia

Bali is famous for its serene beaches and rich culture. However, medical emergencies in remote areas can pose challenges. Travel insurance can cover medical emergencies if you get ill or injured while enjoying a surfing lesson.

2. Paris, France

While soaking in the Eiffel Tower’s beauty, theft can be a concern. Travel insurance with lost luggage coverage ensures you’re not stranded without essentials if your bags don’t arrive.

3. Tokyo, Japan

With its bustling streets and high-tech culture, trips to Tokyo are enchanting. If you plan on trying adventurous activities, like skiing in the Japanese Alps, ensure your insurance covers any injuries from such activities.

FAQs about Travel Guard Insurance Class Action

What triggered the class action against Travel Guard Insurance?

The class action was initiated due to numerous complaints regarding denied claims and lack of clear communication about policy terms.

How can I check if my Travel Guard policy covers my trip?

You can check your policy coverage details by contacting customer service or reviewing your policy documents online.

Is Travel Guard Insurance worth it?

Travel Guard can be worth it if you seek extensive coverage and reliable customer support, but it’s essential to read reviews and compare plans.

What are the best alternatives to Travel Guard Insurance?

Alternatives to Travel Guard include Allianz Travel Insurance and World Nomads, both offering competitive coverage options and pricing.

How do I file a claim with Travel Guard Insurance?

To file a claim, contact Travel Guard’s customer service and follow their claim submission process with the required documentation.

Final Thoughts

Travel Guard Insurance has its advantages and disadvantages, and the ongoing class action highlights the importance of choosing a reliable provider. Always stay informed and ensure your travel plans are backed by comprehensive insurance coverage. Remember, travel should be filled with adventure, laughter, and unforgettable memories—don’t let unforeseen circumstances ruin your journey!