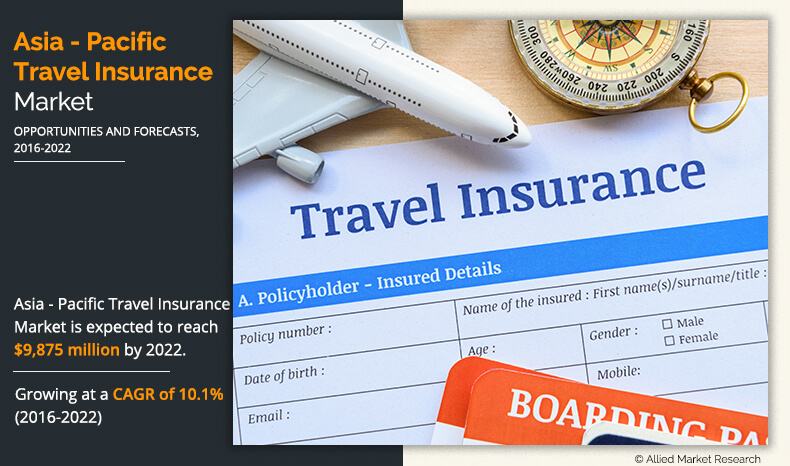

Traveling across Asia can be an exhilarating experience, from bustling markets in Bangkok to serene temples in Kyoto. However, as I discovered on my last trip to the Philippines, the unexpected can occur—and that’s where travel insurance comes into play. In this comprehensive guide, we delve into the significance of travel insurance in Asia, how to choose the right policy, and the best providers available.

Why You Need Travel Insurance for Your Asian Adventures

With so many exciting destinations to explore, travel insurance may not be the first thing on your mind. However, having the right coverage can save you from significant financial losses due to unforeseen circumstances. Here are some reasons why getting travel insurance for Asia is essential:

- Medical Emergencies: Healthcare systems vary greatly in Asia. Medical care can be expensive, especially in countries like Singapore and Japan.

- Trip Cancellations or Delays: Natural disasters in Southeast Asia can disrupt travel plans. Travel insurance offers protection against financial loss due to cancellations.

- Loss or Theft of Belongings: While exploring the vibrant streets of India or the beaches of Bali, the risk of losing your belongings is always present.

- Adventure Activities: Many travelers engage in activities like scuba diving or trekking. Special coverage may be necessary for these high-risk endeavors.

Types of Travel Insurance Policies

Before purchasing travel insurance, it’s crucial to understand the types of policies available. Here’s a breakdown of the most common types of travel insurance you may encounter:

1. Comprehensive Travel Insurance

Comprehensive insurance covers a broad range of potential issues, including medical, cancellation, and personal liability. This is often the best choice for travelers seeking complete peace of mind.

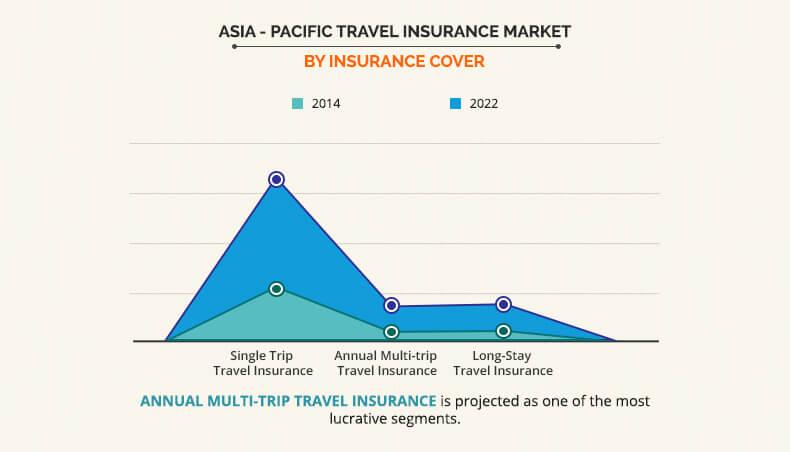

2. Single Trip Travel Insurance

This policy covers only one trip, making it ideal if you plan to travel abroad once in a year. It is more affordable than multi-trip insurance.

3. Multi-Trip Travel Insurance

If you travel frequently, multi-trip insurance is more cost-effective. It covers multiple trips within a year, with each trip usually limited to a specific duration.

4. Adventure Travel Insurance

For thrill-seekers planning activities like mountaineering or extreme sports, this specialized insurance covers high-risk activities that standard policies may not.

How to Choose the Right Travel Insurance for Asia

Choosing a travel insurance policy can be overwhelming, especially with the plethora of options available. Here are some essential tips to guide your decision-making process:

1. Assess Your Travel Needs

Determine the activities you’ll engage in during your travels in Asia. If you’re indulging in adventure sports, ensure your policy covers those activities.

2. Compare Different Policies

Use comparison websites to weigh the pros and cons of various policies. Be sure to check the coverage limits and exclusions.

3. Read Reviews and Ratings

Look for ratings on eCommerce websites for reliable insights. For instance, providers like World Nomads and Allianz Travel receive high marks for customer service and coverage.

4. Understand the Exclusions

Every policy has exclusions. Familiarize yourself with what is not covered to avoid surprises later, such as pre-existing conditions or specific activities.

Top Travel Insurance Providers for Asia in 2023

After analyzing various eCommerce websites and consumer reviews, here’s a comparison of some of the best travel insurance providers for travelers in Asia:

| Provider | Coverage Limits | Adventure Sports Coverage | Medical Emergency Support | Customer Review Rating | Cost (Approx. for 2 weeks) |

|---|---|---|---|---|---|

| World Nomads | $100,000 | Yes | 24/7 | 4.5/5 | USD $120 |

| Allianz Travel | $1,000,000 | No | 24/7 | 4.7/5 | USD $150 |

| AXA Assistance | $1,500,000 | Yes | 24/7 | 4.3/5 | USD $100 |

| SafetyWing | $250,000 | Yes | 24/7 | 4.1/5 | USD $90 |

Personal Experiences: Why Travel Insurance Made a Difference

On my recent trip to Bali, I had a minor accident while exploring the stunning beaches. A slip on a rocky edge resulted in a sprained ankle. Thankfully, I had opted for travel insurance. The medical expenses amounted to USD $300, but my policy covered it all, allowing me to focus on my recovery without worrying about the bills.

In another instance, my travel companion had to cancel a trip due to unforeseen circumstances. While it was disappointing, having travel insurance allowed us to recover a significant portion of our non-refundable expenses.

Destination Highlights: Travel Insurance Considerations for Popular Asian Countries

Thailand

Known for its beautiful islands and rich culture, Thailand is a major tourist destination. Be sure to have insurance covering medical emergencies due to foodborne illnesses.

Vietnam

As you explore the busy streets of Hanoi or the serene waters of Ha Long Bay, remember that travel insurance can cover unexpected incidents like theft or trip delays.

Japan

With excellent healthcare, Japan is a safe destination. However, insurance is still vital for trip cancellations, particularly during typhoon season.

India

From the magnificent Taj Mahal to the bustling markets, India is rich in experiences. Travel insurance should cover medical emergencies, especially if you plan to venture into rural areas.

Pros and Cons of Purchasing Travel Insurance

Pros:

- Financial protection against unforeseen events

- Peace of mind during travel

- Coverage for adventure sports and activities

Cons:

- It can be an additional expense on top of travel costs

- Some policies may not cover specific activities

- Complicated claims process if not well documented

Frequently Asked Questions (FAQs)

1. What is the average cost of travel insurance for Asia?

The average cost for a two-week policy in Asia is approximately USD $100 to $150, depending on coverage levels and activities planned.

2. Does travel insurance cover COVID-19 related issues?

Many travel insurance providers now offer specific coverage related to COVID-19, including trip cancellations and medical expenses. Always check the terms of your policy.

3. Can I buy travel insurance after booking my trip?

Yes, you can purchase travel insurance at any time before your trip. However, you should buy it as soon as possible for the best coverage options.

4. How do I file a claim with my travel insurance provider?

To file a claim, contact your insurer directly. Be prepared to provide documentation such as receipts, photos, and a police report if necessary.

Travel Tips: Ensuring a Hassle-Free Experience

Here are some additional travel tips to ensure a smooth experience:

- Stay Updated: Keep up with the latest travel advisories and health recommendations for the countries you plan to visit.

- Know Emergency Numbers: Familiarize yourself with local emergency contact numbers for quick access in case of an emergency.

- Make Copies of Important Documents: Store digital and physical copies of your insurance policy, passport, and other essential documents.

- Stay Connected: Consider having local data or Wi-Fi available for easy communication with your insurance provider if needed.

Conclusion

Traveling in Asia can be one of the most rewarding experiences of your life. However, don’t overlook the importance of travel insurance. With the right policy in place, you can explore this beautiful continent with confidence, knowing you’re covered in case of emergencies. Remember, travel insurance is not just an added expense—it’s a crucial investment in your peace of mind.