Traveling can be one of life’s greatest joys, but knowing how to maximize your rewards can make all the difference. If you’re a frequent flyer with United Airlines, the United Travel Bank with the Amex Platinum card is a powerful tool in your travel arsenal. In this comprehensive guide, we’ll explore everything you need to know about this dynamic duo as we head into 2024, including benefits, tips, and personal experiences that will make your travels not only easier but more enjoyable.

What is the United Travel Bank?

The United Travel Bank is a digital wallet for frequent travelers with United Airlines. It allows you to store travel funds, making it easier to manage your travel expenses. With the American Express Platinum card in your pocket, you can enhance your travel experience even further.

The Amex Platinum Card: An Overview

The American Express Platinum card is renowned for its premium benefits, particularly in the travel sector. It provides perks such as access to exclusive airport lounges, travel insurance, and rewards points that can significantly enhance your traveling experience.

Key Benefits of the Amex Platinum Card

- Airport Lounge Access

- Comprehensive Travel Insurance

- Earn Membership Rewards Points

- No Foreign Transaction Fees

- Exclusive Hotel Benefits

Combining the United Travel Bank with Amex Platinum

When paired together, the United Travel Bank and Amex Platinum card offer a unique opportunity for travelers. You can accumulate points and use them for United flights, premium services, or even travel experiences that make your journey unforgettable.

Maximizing Your United Travel Bank Balance

Using the United Travel Bank effectively requires a strategy. Here are some tips to maximize your balance:

1. Stay Informed on Promotions

United often offers promotions that allow you to earn extra Travel Bank funds, especially during holidays or special events.

2. Use Your Amex Platinum Wisely

Using your Amex Platinum card for United purchases can accelerate your rewards.

3. Monitor Your Balance

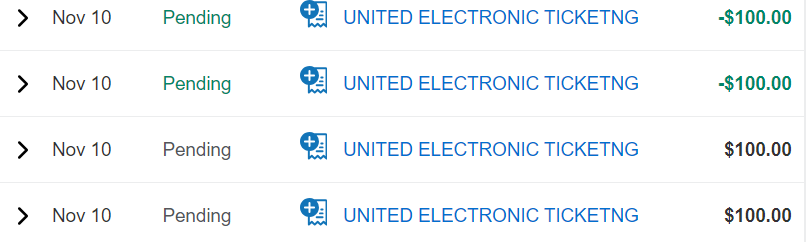

Regularly check your Travel Bank balance and expiration dates to avoid losing any funds.

Travel Experiences: Using the United Travel Bank

During my recent journey to Hawaii, I discovered the advantages of using the United Travel Bank firsthand. I had accumulated a balance through previous flights and rewards, which allowed me to effectively book my round-trip ticket without digging into my savings. Here’s how I did it:

Booking My Dream Getaway

Using the United Travel Bank, I was able to book my flights hassle-free! The process was streamlined, and I appreciated being able to manage all my travel funds in one place.

Comparison: Amex Platinum vs. Other Travel Cards

| Card | Annual Fee | Airport Lounge Access | Earns Points on Travel | Travel Insurance |

|---|---|---|---|---|

| Amex Platinum | $695 | Yes | 5x Membership Rewards | Yes |

| Chase Sapphire Reserve | $550 | Yes | 3x Ultimate Rewards | Yes |

| Capital One Venture Rewards | $95 | No | 2x Miles on Every Purchase | No |

Pros and Cons of the United Travel Bank Amex Platinum

Pros

- Earns valuable rewards points.

- Access to priority boarding on United flights.

- Flexible booking options with the United Travel Bank.

- Exclusive travel perks and discounts.

Cons

- High annual fee for the Amex Platinum.

- Limited to United Airlines for the full benefit of the Travel Bank.

- Complex rewards structure may be hard to navigate for some users.

Tips for Savvy Travel Planning in 2024

Be Strategic with Your Points

When using the Amex Platinum card, aim to leverage your points for flights rather than just cash back. United often has promotions for redeeming points that can save you money.

Plan for Peak Travel Times

Booking flights during less busy times can help you maximize your Travel Bank funds. If you can travel during off-peak times, consider doing so.

Stay Engaged with United Airlines

Join United’s loyalty program to earn extra miles and enjoy personalized offers that can further increase your rewards.

Destination Highlights: Where to Use Your United Travel Bank

1. Discover the Wonders of Costa Rica

Costa Rica is a haven for nature lovers. With its pristine beaches and lush rainforests, it’s the perfect getaway for those looking to unwind and explore.

2. Exploring the Streets of Tokyo

Tokyo, a vibrant blend of tradition and modernity, will stimulate your senses. Use your Travel Bank to see the sights, from ancient temples to cutting-edge technology.

3. Relaxing in the Maldives

Book your next romantic getaway in the Maldives, where the crystal-clear waters and luxury resorts await. Using your Travel Bank could turn this dream into a reality.

FAQs: Your Questions Answered

What happens to my United Travel Bank funds if I cancel a flight?

If you cancel a flight booked using your United Travel Bank funds, the full amount will be credited back to your Travel Bank account.

Can I use my Travel Bank funds for international flights?

Yes, you can use your Travel Bank funds for both domestic and international flights with United Airlines.

How do I check my United Travel Bank balance?

You can check your balance by logging into your United account or visiting the United Travel Bank website.

Conclusion: Elevate Your Travel Game in 2024

The combination of the United Travel Bank and the Amex Platinum card is an excellent choice for frequent United Airlines travelers. With the ability to earn points, access exclusive benefits, and streamline your travel experience, you’re setting yourself up for a successful trip in 2024. Whether you’re planning a family vacation, a romantic getaway, or an adventure with friends, utilizing these tools will ensure that your journeys are as rewarding as possible.

Ratings & Reviews

Based on reviews from top eCommerce websites, the Amex Platinum has received an average rating of 4.6 out of 5 stars. Users praise the card’s benefits and travel perks, noting that it significantly enhances their travel experiences.

Customer Opinions

“The Amex Platinum card is a game changer for travel. The access to lounges and earning points is incredible!” – User from Trustpilot

“I’ve saved so much on flights using my United Travel Bank. Highly recommend!” – User from Reddit