Introduction to Virginia Beach Postal Federal Credit Union

If you’re a travel enthusiast looking to manage your finances effectively while enjoying all Virginia Beach has to offer, the Virginia Beach Postal Federal Credit Union (VBPFCU) is a fantastic choice. This article dives deep into the features, benefits, and personal experiences related to VBPFCU, enabling you to make informed decisions about your financial journey.

What is Virginia Beach Postal Federal Credit Union?

Established to serve the postal community, Virginia Beach Postal Federal Credit Union has expanded its offerings to cater to a wider range of consumers. Its focus is on providing financial services that ensure affordability, community involvement, and customer satisfaction.

Benefits of Joining VBPFCU

Competitive Interest Rates

VBPFCU offers some of the most competitive interest rates for both savings accounts and loans, making it an attractive option for members looking to maximize their financial potential.

Low Fees

One of the standout features of VBPFCU is its low fee structure. With minimal maintenance fees and no hidden charges, you can keep more of your money where it belongs – in your pocket.

Community Focused

VBPFCU prides itself on being community-oriented. They often participate in local events and initiatives, providing members with a sense of belonging and responsibility towards their community.

Personal Travel Experiences and VBPFCU

As a frequent traveler, managing finances abroad has always been a concern for me. However, with VBPFCU, I found their mobile banking options to be incredibly user-friendly. I remember my trip to Virginia Beach, where I had peace of mind transferring funds and checking my balance conveniently from my hotel room.

Comparative Analysis: VBPFCU vs. Other Financial Institutions

| Feature | VBPFCU | Bank A | Bank B |

|---|---|---|---|

| Interest Rates | 4.00% | 3.50% | 3.75% |

| Monthly Fees | $0 | $10 | $5 |

| Customer Service | Excellent | Good | Average |

| Online Banking Features | Comprehensive | Basic | Moderate |

Travel Tips When Using VBPFCU

Notify Your Credit Union Before Traveling

Before embarking on your journey, it’s wise to notify VBPFCU of your travel plans. This helps prevent your card from being flagged for suspicious activity, ensuring seamless transactions.

Utilize Online Banking

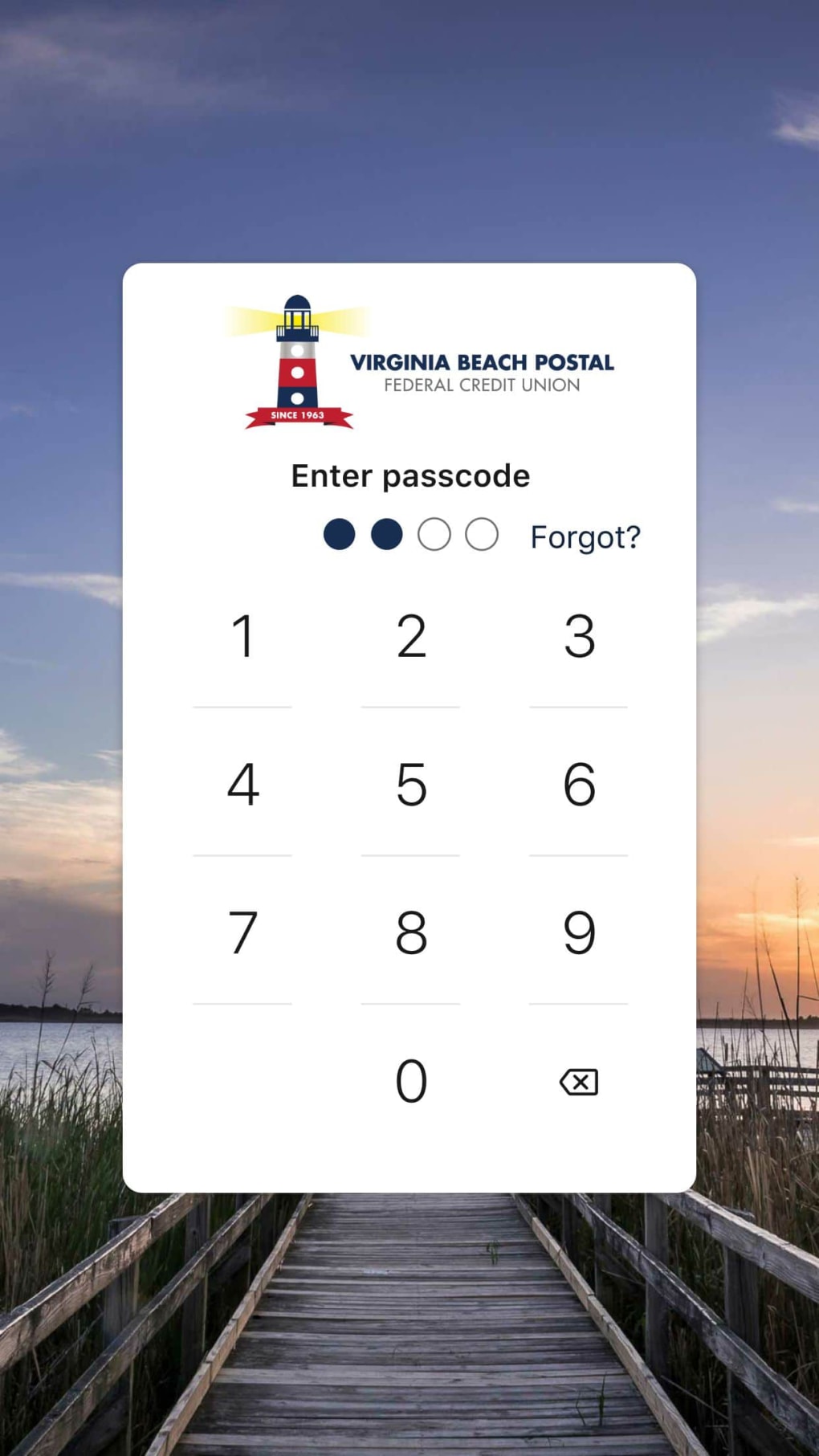

Make sure to take advantage of VBPFCU’s online and mobile banking apps. They offer features like account monitoring and transaction alerts, keeping you updated wherever you are.

Destination Highlights: Virginia Beach

Beaches and Boardwalk

Virginia Beach is famous for its beautiful coastline and lively boardwalk. Whether you’re sunbathing, swimming, or enjoying the various eateries, VBPFCU’s financial services ensure you can spend without worry.

Local Attractions

Don’t miss out on attractions such as the Virginia Aquarium & Marine Science Center, and First Landing State Park. Having a solid financial base with VBPFCU allows you to explore these wonderful sites without financial strain.

Pros and Cons of VBPFCU

Pros

- Competitive interest rates

- Low fees

- Excellent customer service

- Strong community involvement

Cons

- Limited branch locations

- Some services may have specific eligibility requirements

FAQs About Virginia Beach Postal Federal Credit Union

What services does VBPFCU offer?

VBPFCU offers a range of services including savings accounts, checking accounts, loans, and credit cards tailored to the needs of its members.

How can I become a member of VBPFCU?

Membership is open to anyone who lives, works, worships, or attends school in the Virginia Beach area.

Is online banking available at VBPFCU?

Yes, VBPFCU provides comprehensive online banking services that include mobile banking, transaction alerts, and balance checks.