As a seasoned travel enthusiast, I’ve learned that while exploring the world is exhilarating, managing the finances of a travel agency can be daunting. Whether you’re a startup travel agency or an established tour operator, having the right accounting software can transform your operations and improve your financial health. In this comprehensive guide, we will delve into the best travel agency accounting software available, share personal travel experiences, and provide valuable tips for managing your finances in the travel industry.

Why Travel Agency Accounting Software is Essential

Accounting is often the tedious part of running a travel agency. However, with the right software, it can be streamlined and simplified. Here’s why you need specialized accounting software:

- Efficiency: Automates tasks that would otherwise take hours, such as invoicing and expense tracking.

- Accuracy: Reduces the likelihood of human error in financial reporting.

- Insights: Offers reporting features that provide insights into your business’s financial health.

- Compliance: Helps ensure that your financial practices meet regulatory requirements.

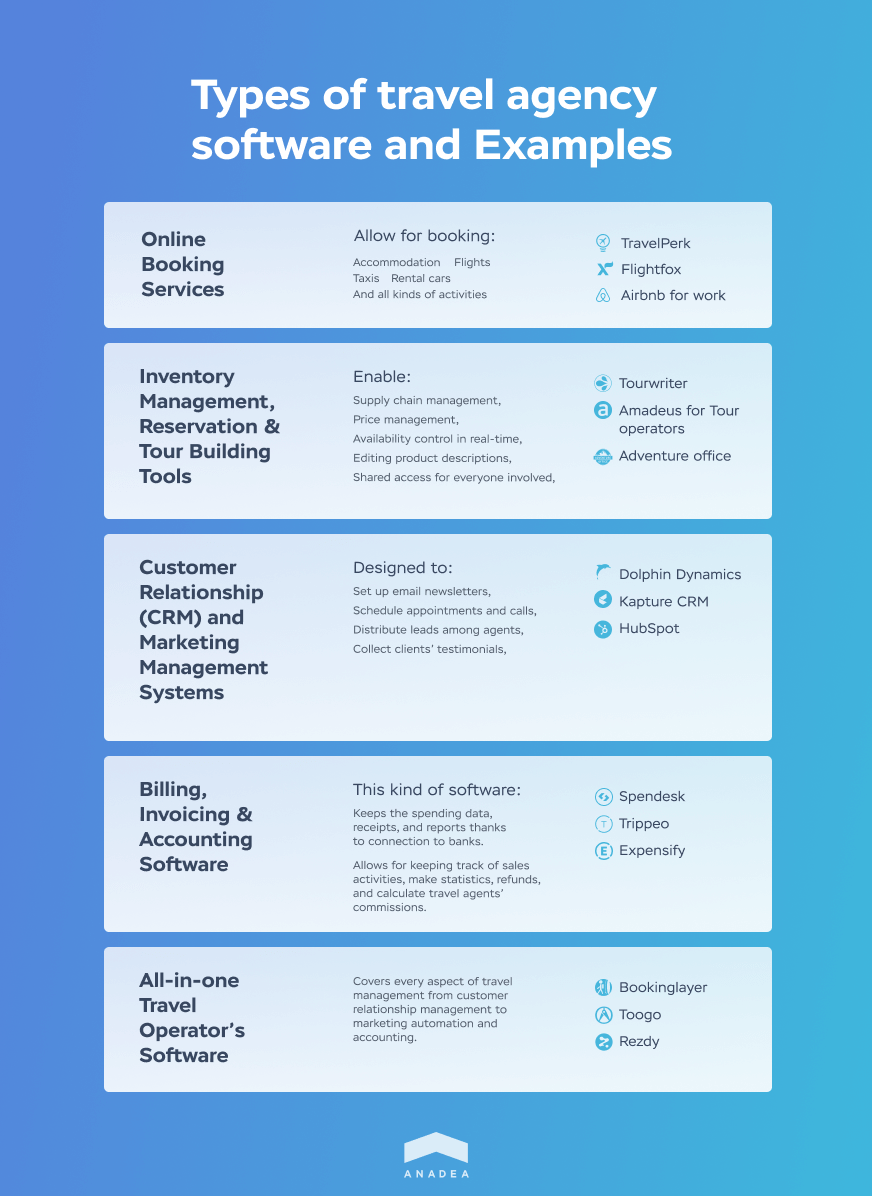

Key Features to Look for in Travel Agency Accounting Software

Choosing the right accounting software can be overwhelming, especially with the myriad of options available. Here are some key features you should consider:

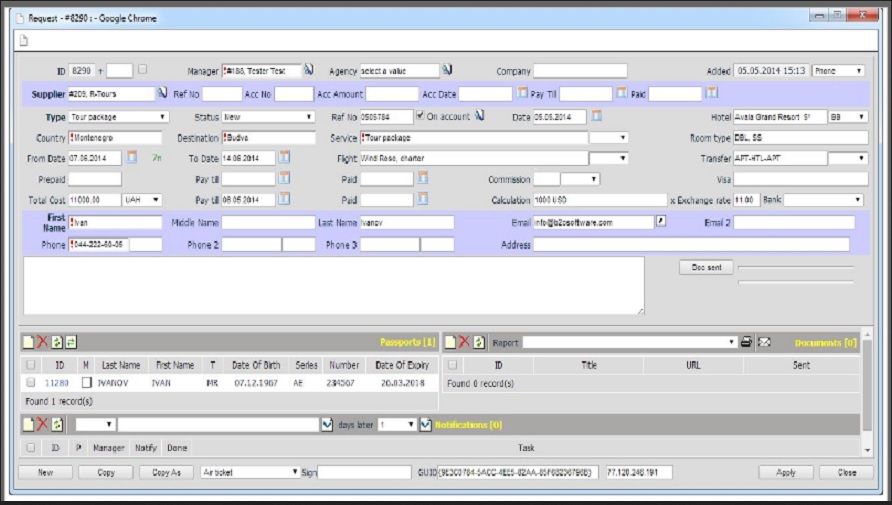

1. Invoicing and Billing

Look for software that allows you to create professional invoices quickly and automate recurring billing.

2. Expense Tracking

Efficient expense tracking features can help you monitor your spending and manage your budget effectively.

3. Reporting and Analytics

Dashboards and customizable reports are crucial for understanding your financial position at any time.

4. Integration with Other Tools

Ensure that the software integrates seamlessly with other tools you’re using, such as CRM systems or travel booking platforms.

5. Multi-Currency Support

If your agency deals with international clients, multi-currency support is essential for accurate transactions.

Top Travel Agency Accounting Software Options Compared

To help you find the perfect fit for your travel agency, we’ve compiled a comparison table of some of the top accounting software options:

| Software Name | Rating | Price | Key Features |

|---|---|---|---|

| QuickBooks Online | 4.5/5 | Starting at $25/month | Invoicing, Expense Tracking, Reporting, Multi-Currency |

| Xero | 4.5/5 | Starting at $12/month | Invoicing, Inventory, Reporting, Mobile App |

| FreshBooks | 4.4/5 | Starting at $15/month | Invoicing, Time Tracking, Expense Tracking, Reporting |

| Zoho Books | 4.5/5 | Starting at $15/month | Invoicing, Expense Tracking, Automation, Reporting |

| TravelAccount | 4.7/5 | Contact for pricing | Travel-specific features, Invoicing, Reports, Multi-Currency |

Customer Reviews and Insights

Feedback from actual users provides invaluable insights into how well each software performs. Here are some highlights from reviews on popular eCommerce websites:

1. QuickBooks Online

Users appreciate its user-friendly interface and comprehensive reporting. Many highlight the efficiency of automated invoicing and expense categorization, which saves them hours each month.

2. Xero

Xero is frequently praised for its strong integration capabilities with other apps, making it a favorite among digitally-savvy travel agents. Users note its easy navigation and robust reporting features.

3. FreshBooks

FreshBooks earns high marks for its customer support and straightforward design, making it ideal for small travel agencies. Users love its time tracking feature, which helps keep projects on budget.

4. Zoho Books

Users appreciate Zoho Books for its budget-friendly pricing and extensive features. The automation options are particularly valued for reducing manual workload.

5. TravelAccount

TravelAccount is tailored explicitly for travel agencies and has received excellent feedback for its travel-specific features. Users report high satisfaction with its multi-currency handling and billing processes.

How to Select the Right Travel Agency Accounting Software for You

With so many options available, how do you choose the right accounting software for your travel agency? Here are some tips to guide your decision:

1. Determine Your Needs

Assess what features are most critical for your operations. Are you managing a high volume of invoices? Do you need to track expenses closely? List out your priorities.

2. Consider Your Budget

Software can vary significantly in cost. Ensure you consider both upfront and ongoing costs, including any extra fees for features you may need.

3. Take Advantage of Free Trials

Most software options offer free trials. Use this opportunity to test the features and see if it fits your workflow before making a commitment.

4. Ask for Recommendations

Talk to fellow travel agency owners or join forums to get recommendations based on real experiences.

5. Prioritize Scalability

Your business may grow, so opting for software that can scale with your needs can save you from having to switch solutions later.

Travel Tips and Experiences

As someone who has traveled to over 30 countries, I’ve had my share of adventures and misadventures. Here are some personal travel tips that can enhance your journeys and perhaps also that of your clients:

1. Stay Organized

Keep all travel documents easily accessible, both in digital and paper formats. A cloud-based storage solution can be a lifesaver!

2. Learn Basic Local Phrases

Even a simple “hello” or “thank you” in the local language can enhance your interactions with locals and create memorable experiences.

3. Use Technology Wisely

Apps for navigation, translation, and travel planning can save you time and reduce stress. Just ensure your phone is charged!

4. Embrace Local Cuisine

Food is an integral part of travel. Trying local dishes not only enriches your experience but can also be a conversation starter for clients when pitching destinations.

5. Stay Flexible

Plans can change, and flexibility can lead to unplanned adventures that might just turn into the highlight of your trip!

Destination Highlights: Travel Agencies You Can Trust

As travel enthusiasts, we often look for reliable agencies to book our vacations. Here are some notable options:

1. Travel Leaders

Known for their extensive network of travel advisors, they offer personalized service and a wide range of travel experiences.

2. Expedia

One of the largest online travel agencies, Expedia is convenient for booking flights, hotels, and activities all in one place.

3. Viator

Viator specializes in tours and activities, making it a great option for travelers looking to enhance their itineraries with local experiences.

Pros and Cons of Using Travel Agency Accounting Software

Here’s a quick overview of the pros and cons to help you make an informed decision:

Pros

- Increases efficiency by automating repetitive tasks.

- Provides better financial insights through advanced reporting features.

- Enhances accuracy and reduces the risk of errors in financial management.

- Offers multi-currency support, essential for international travel agencies.

- Facilitates compliance with financial regulations and tax laws.

Cons

- Initial learning curve, especially for those unfamiliar with accounting software.

- Costs can add up, particularly for premium features or higher-tier plans.

- Dependence on technology; system outages can disrupt operations.

FAQs About Travel Agency Accounting Software

1. What is travel agency accounting software?

Travel agency accounting software is specially designed to help travel agencies manage their financial tasks such as invoicing, expense tracking, and reporting efficiently.

2. How much does travel agency accounting software cost?

Costs can vary widely, ranging from $12 to $50 or more per month, depending on the features and capabilities of the software.

3. Can I manage multiple currencies with travel agency accounting software?

Yes, many travel agency accounting software options offer multi-currency support, making it easier to manage international transactions.

4. Is it worth investing in accounting software for a small travel agency?

Absolutely! Investing in good accounting software can save you time, reduce errors, and offer insights that support business growth.

5. Can I integrate travel agency accounting software with my booking system?

Most modern accounting software offers integration capabilities with popular booking systems, enhancing your overall operational efficiency.

Conclusion

As travel agency owners and enthusiasts, managing your finances shouldn’t hold you back from chasing your travel dreams. With the right accounting software, you can streamline your operations, gain valuable insights, and spend more time doing what you love – exploring the world! Whether you choose QuickBooks Online, Xero, or TravelAccount, ensure that the software aligns with your business needs and keeps your financial health in check. Happy travels!