Travel agencies play a crucial role in the tourism industry, acting as intermediaries between travelers and service providers like airlines, hotels, and tour operators. However, like any business, travel agencies face risks that could result in financial loss. One way to protect against these risks is through comprehensive travel agency insurance coverage. In this guide, we will explore the importance of insurance for travel agencies, the types of coverage available, tips for selecting the right policy, and personal experiences that highlight its necessity.

Understanding Travel Agency Insurance Coverage

What is Travel Agency Insurance?

Travel agency insurance is a specialized form of business insurance designed to protect travel agencies from various liabilities. This coverage can safeguard against potential lawsuits, claims from clients, loss of income due to specific events, and damage to property.

Why is Insurance Important for Travel Agencies?

Many travel agencies operate under tight margins, and an unexpected incident can lead to substantial financial losses. Having the right insurance not only protects your business but also builds trust with your clients. Providing assurance that they are protected in case something goes wrong can be a significant selling point.

Common Risks Faced by Travel Agencies

- Client cancellations and no-shows

- Errors and omissions in travel planning

- Travel supplier insolvencies

- Natural disasters affecting destinations

- General liability claims

Types of Insurance Coverage for Travel Agencies

1. General Liability Insurance

This is one of the most critical types of insurance for any business, including travel agencies. General liability insurance protects against claims of bodily injury, property damage, and personal injury. For example, if a client trips in your office and injures themselves, general liability insurance can cover medical expenses and legal fees.

2. Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, this coverage is essential for protecting against claims of negligence. If a client claims that you provided inaccurate information about a destination, leading to a poor experience, professional liability insurance can help cover the costs of defending against such claims.

3. Business Interruption Insurance

This type of insurance offers protection against loss of income due to unforeseen events that disrupt your business operations. For instance, if a natural disaster closes your office for weeks, business interruption insurance can help you cover operating expenses during that time.

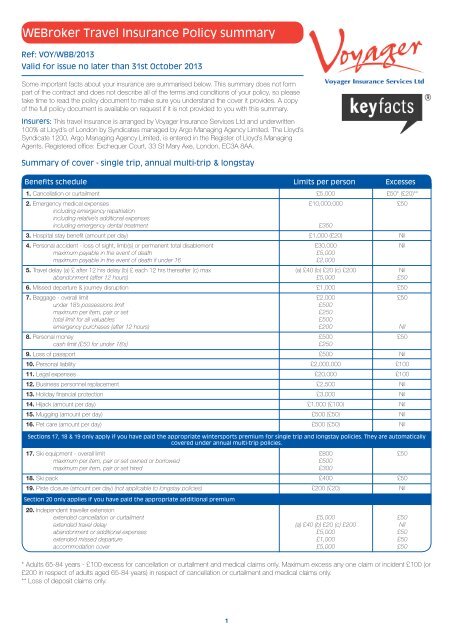

4. Travel Insurance for Clients

While not directly for your agency, offering travel insurance to clients can be a value-added service. This coverage protects clients against unexpected events like trip cancellations, medical emergencies, or lost baggage, enhancing their travel experience and reducing your liability.

5. Cyber Liability Insurance

In today’s digital world, cyber liability insurance is becoming increasingly important for travel agencies. This coverage can protect against data breaches and cyberattacks, which can jeopardize client information and trust.

Choosing the Right Travel Agency Insurance Coverage

Factors to Consider

When selecting insurance for your travel agency, consider the following:

- Your Agency’s Size: Larger agencies might require more extensive coverage options.

- Services Offered: If you offer specialized travel services, ensure your coverage reflects that.

- Location: Risks vary by location; consider local laws and prevalent threats.

- Client Demographics: The age and travel habits of your clients may influence your insurance needs.

Tips for Finding the Best Policy

- Research and compare different insurance providers.

- Read customer reviews to gauge satisfaction levels.

- Consult with an insurance broker specializing in travel businesses.

- Ensure the policy aligns with your specific business needs.

- Review the coverage limits and deductibles carefully.

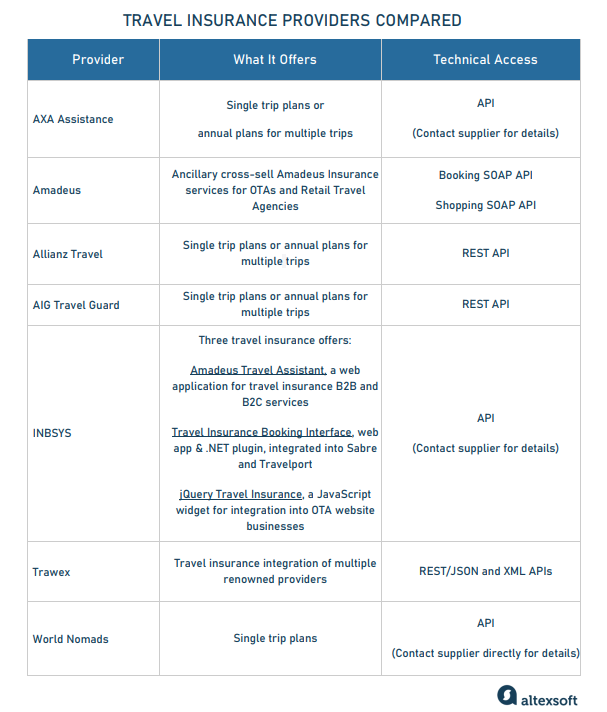

Comparison of Top Travel Agency Insurance Providers

| Provider | Coverage Types | Customer Rating | Price Range | Pros | Cons |

|---|---|---|---|---|---|

| TravelGuard | General Liability, E&O, Business Interruption | 4.5/5 | $400 – $1200/year | Comprehensive coverage, strong customer service | Higher premiums for extensive coverage |

| Hiscox | General Liability, Professional Liability | 4.7/5 | $350 – $1000/year | Customizable policies, easy online quotes | Limited claims history data available |

| The Hartford | General Liability, Business Interruption | 4.6/5 | $300 – $800/year | Good for small to mid-sized agencies | Somewhat slow claims process |

Personal Travel Experience: Insurance in Action

During my recent trip to Bali, I encountered a situation that truly highlighted the importance of having travel agency insurance. One of my clients, who booked a luxury resort through my agency, faced a last-minute cancellation due to a family emergency. Thankfully, we had offered travel insurance as an add-on, which allowed them to recover most of their costs. It was a reminder of how essential it is to safeguard not just the agency but also the travelers we serve.

Travel Tips for Travelers and Agents Alike

- Always offer travel insurance: As a travel agency, it’s beneficial to present travel insurance as an option at checkout.

- Educate clients: Provide information on why insurance is crucial for peace of mind.

- Stay informed: Understand the latest risks and trends in travel so you can offer informed advice.

- Network with insurance brokers: Building relationships with brokers can help you stay updated on the best policies available.

Destination Highlights for Insured Travelers

With the right insurance, travelers can explore destinations like:

1. Japan

Known for its rich culture and hospitality, Japan is a safe destination with excellent healthcare systems. However, travel insurance can cover unexpected incidents during your stay.

2. Italy

With beautiful landscapes and scrumptious food, Italy attracts millions. Insurance is crucial in case of cancellations or emergencies in a foreign country.

3. Australia

Australia’s breathtaking scenery and vibrant cities are a traveler’s dream, but natural disasters can occur, making insurance even more important.

Common FAQs About Travel Agency Insurance Coverage

What is the average cost of travel agency insurance?

The average cost of travel agency insurance can range from $300 to $1200 per year, depending on the coverage types and the size of your agency.

Is professional liability insurance mandatory for travel agencies?

While it’s not legally mandatory, having professional liability insurance is highly recommended to protect against potential claims of negligence.

Can travel insurance be purchased for specific trips?

Yes, travelers can purchase travel insurance for specific trips, covering risks such as trip cancellations and medical emergencies.

How often should I review my insurance policy?

It’s advisable to review your insurance policy annually or whenever you expand your agency’s services to ensure adequate coverage.

What should I do if I need to file a claim?

If you need to file a claim, contact your insurance provider immediately, gather all necessary documentation, and follow their claims process diligently.

Final Thoughts

Investing in travel agency insurance is not just a financial necessity; it’s a commitment to providing safe and secure services to your clients. In this unpredictable industry, the peace of mind that comes from comprehensive coverage allows you to focus on what you do best—creating unforgettable travel experiences. Whether you are a seasoned travel agent or just starting, understanding the nuances of insurance can save you—and your clients—significant trouble down the road.