Traveling is one of life’s greatest pleasures, and as someone who has explored various corners of the world, I can attest to the wonders that await each traveler. However, amidst the breathtaking landscapes and vibrant cultures, there lies the importance of being prepared for the unexpected. That’s where travel insurance comes into play. In this comprehensive guide, we will delve deep into the realm of travel insurance in Pakistan, equipping you with all the knowledge you need to make informed decisions for your next adventure.

What is Travel Insurance?

Travel insurance is a policy designed to cover various risks associated with traveling, be it domestic or international. This includes trip cancellations, medical emergencies, loss of luggage, and more. The right policy can provide peace of mind, allowing you to focus on enjoying your trip.

Why You Need Travel Insurance in Pakistan

Pakistan is a country of diverse landscapes and rich history. However, like any travel destination, it comes with its own set of risks, including natural disasters, political unrest, and health-related emergencies. Having travel insurance ensures that you are financially protected against these unforeseen circumstances.

Types of Travel Insurance Policies

1. Comprehensive Travel Insurance

This type of policy covers a broad range of incidents, including trip cancellation, medical expenses, lost baggage, and personal liability. It is ideal for travelers who want full coverage.

2. Medical Insurance for Travelers

Focused primarily on covering health-related expenses, this option is suitable for those who travel frequently or to remote areas where medical care might not be readily available.

3. Trip Cancellation Insurance

This policy reimburses you for non-refundable expenses if you have to cancel your trip due to covered reasons, such as illness or unforeseen events.

Key Factors to Consider When Choosing Travel Insurance

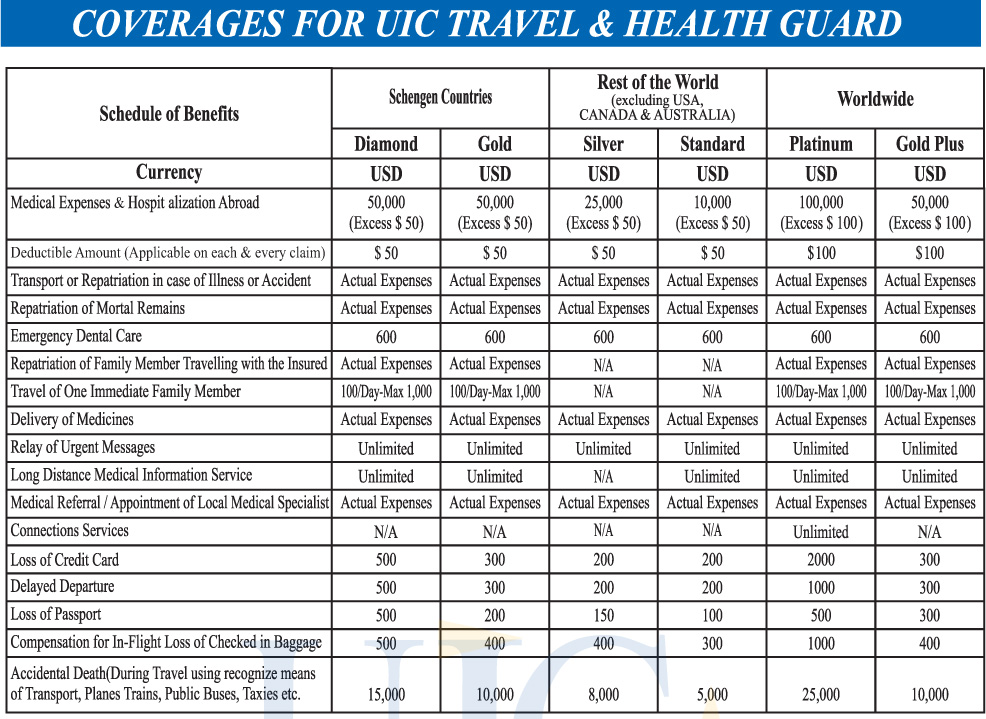

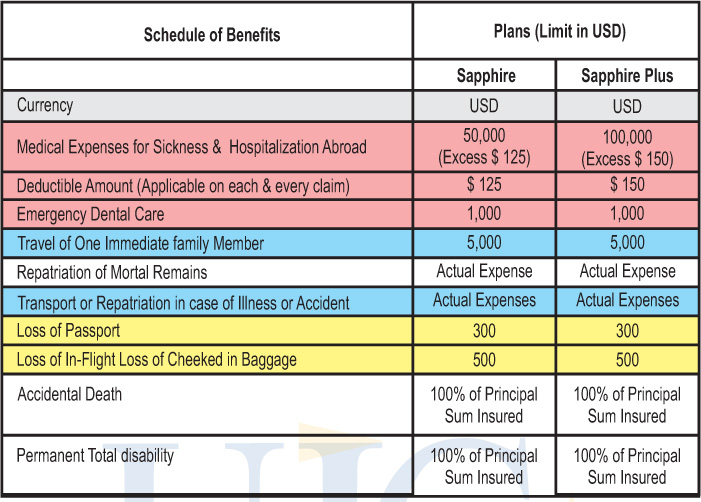

1. Coverage Limits

Always check the maximum coverage limits of the policy. Make sure the limits are adequate for your destination and activities planned during the trip.

2. Exclusions

Read the fine print! Common exclusions may include pre-existing conditions, adventure sports, or travel to specific regions. Knowing these beforehand can save you from unexpected surprises.

3. Customer Support

In case of emergencies, having access to a reliable customer support system is crucial. Opt for policies that offer 24/7 assistance.

Comparison of Top Travel Insurance Providers in Pakistan

| Provider | Coverage Type | Coverage Limits | Premium (Approx.) | Customer Rating |

|---|---|---|---|---|

| Allianz | Comprehensive | $1,000,000 | $50 | 4.5/5 |

| Jubilee General | Medical | $500,000 | $40 | 4.2/5 |

| Pak Oman Investment | Trip Cancellation | $200,000 | $30 | 4.0/5 |

Pros and Cons of Travel Insurance in Pakistan

Pros

- Provides peace of mind while traveling.

- Covers unexpected medical expenses.

- Reimburses non-refundable trip costs in case of cancellations.

- Offers support in emergencies.

Cons

- Additional cost to your travel budget.

- Complex policies with fine print.

- Some exclusions may not be evident.

Personal Travel Experience: Why I Never Travel Without Insurance

During my backpacking trip through the breathtaking valleys of northern Pakistan, I encountered unexpected challenges. One evening, while trekking up to the stunning Naltar Valley, I sprained my ankle. If it weren’t for my travel insurance, I would have been burdened with hefty medical bills and the costs of altering my travel plans.

My insurance not only covered my medical expenses but also allowed for a seamless rebooking process for my flights. This experience reinforced the value of having travel insurance, especially in remote areas where access to healthcare is limited.

How to Purchase Travel Insurance in Pakistan

Step 1: Research

Start by researching various providers online. Websites like IFA and Jubilee General have user-friendly platforms to compare options.

Step 2: Assess Your Needs

Consider the nature of your travel. Are you going for leisure or business? Will you partake in adventurous activities? Your answers will guide you towards the right policy.

Step 3: Get Quotes

Obtain quotes from different providers. Most websites allow you to customize your coverage based on your travel itinerary and required limits.

Step 4: Read Reviews

Check reviews on platforms such as Trustpilot to gauge the experiences of fellow travelers.

Step 5: Purchase and Keep Documentation

Once you’ve made your choice, purchase the policy and keep a digital and physical copy of all documents, including policy numbers and emergency contact numbers.

Travel Tips for a Smooth Journey

1. Understand Local Regulations

Before traveling, familiarize yourself with the local laws and customs of your destination, especially regarding health and safety.

2. Pack Smart

Always pack a first aid kit and any necessary medications to avoid dependence on local pharmacies.

3. Stay Informed

Keep track of news related to your destination, especially regarding safety alerts or health advisories.

4. Purchase Insurance Before Booking

Try to purchase travel insurance as soon as you book your trip. This ensures maximum coverage for trip cancellation benefits.

FAQs About Travel Insurance in Pakistan

1. What does travel insurance typically cover?

Travel insurance commonly covers medical emergencies, trip cancellations, lost luggage, and personal liability.

2. Is travel insurance mandatory in Pakistan?

While it’s not legally required, many travelers opt for it to mitigate risks associated with travel.

3. Can I buy travel insurance after booking my trip?

Yes, you can buy insurance after booking, but earlier purchases offer more benefits, including trip cancellation coverage.

4. Is adventure sports covered under travel insurance?

This varies by policy; some insurance providers offer specific plans that include coverage for adventure sports.

Conclusion

Travel insurance is a vital aspect of planning any trip, especially in a country as diverse and rich as Pakistan. With the right information and understanding of your needs, you can select a policy that not only protects you but enhances your travel experience. Don’t let unforeseen incidents hinder your adventures. Equip yourself with travel insurance and embark on your journeys with confidence!