Traveling to the beautiful islands of the Philippines is an exciting adventure, but ensuring you have the right travel insurance can make all the difference. As someone who has traveled extensively throughout the Philippines, I’ve encountered my fair share of unexpected mishaps, which highlights the importance of being prepared. In this guide, we’ll explore everything you need to know about travel insurance in the Philippines, including tips, comparisons, and personal experiences that will help you choose the best policy for your journey.

Why You Need Travel Insurance

Travel insurance serves as a safety net when things go wrong during your trip. Here are some key reasons why you should consider getting travel insurance:

- Medical Emergencies: Health care in the Philippines can be costly, especially in private hospitals. Insurance can cover unexpected medical expenses.

- Trip Cancellations: If unforeseen circumstances force you to cancel your trip, travel insurance can reimburse non-refundable expenses.

- Lost or Stolen Belongings: Protect your belongings against theft or loss during transit or while on vacation.

- Emergency Evacuations: In case of serious illnesses or natural disasters, insurance may cover transportation costs to a medical facility.

Types of Travel Insurance Available in the Philippines

1. Single Trip Insurance

This is ideal for travelers planning a one-time trip. It covers you for the duration of your trip from the time you leave until you return.

2. Annual Multi-Trip Insurance

If you travel frequently, consider an annual policy that covers multiple trips for a year. This can save you time and money.

3. Domestic Travel Insurance

Travelers within the Philippines may benefit from domestic travel insurance, covering local flights and accommodations.

4. Adventure Sports Travel Insurance

Planning to snorkel, dive, or hike? Get specialized insurance that covers adventure activities, as regular policies may not.

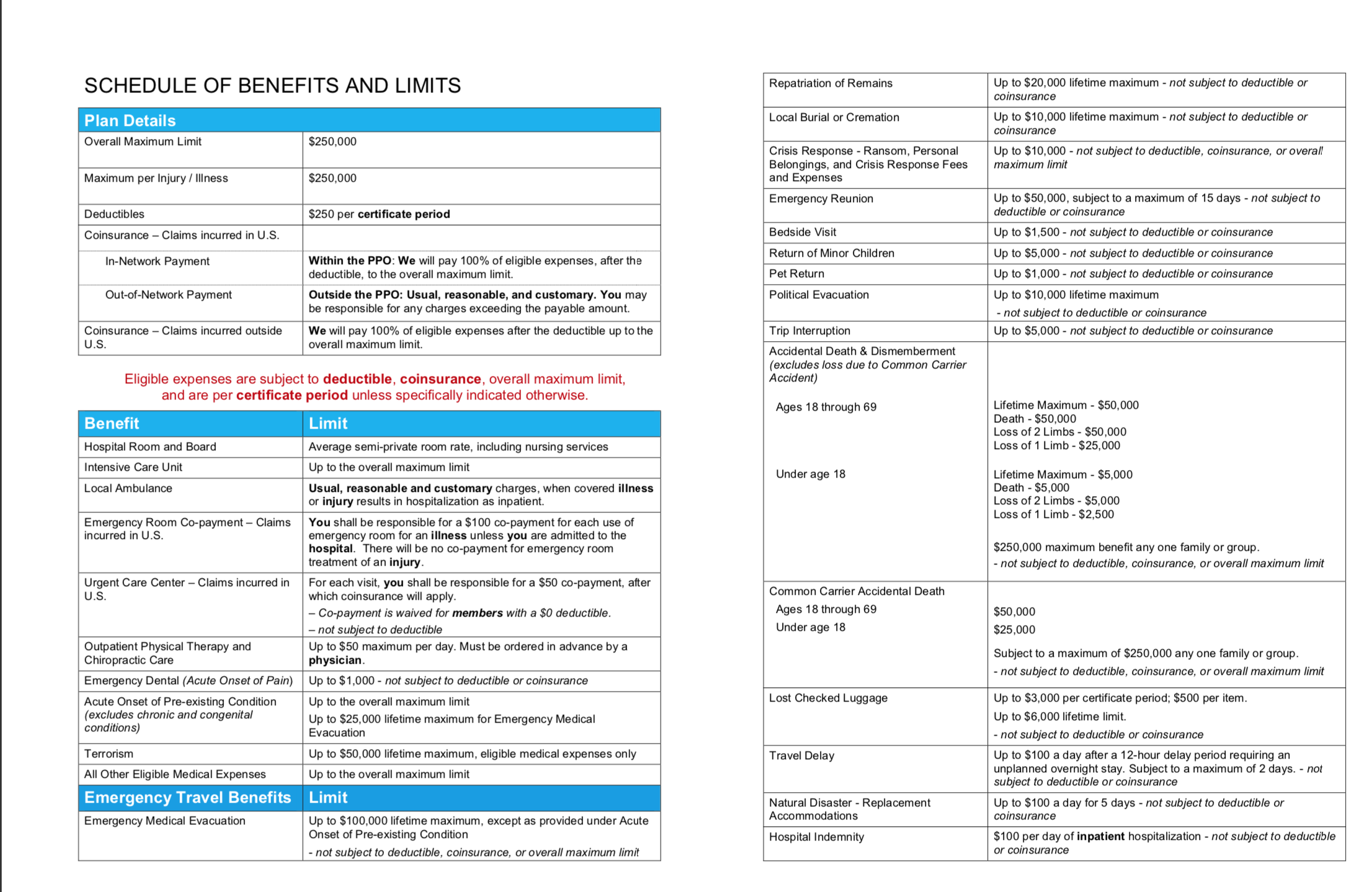

Comparing the Top Travel Insurance Providers

| Provider | Coverage Amount | Medical Coverage | Trip Cancellation | Cost (Approx.) | Rating |

|---|---|---|---|---|---|

| World Nomads | $100,000 | $100,000 | Yes | $50/month | 4.7/5 |

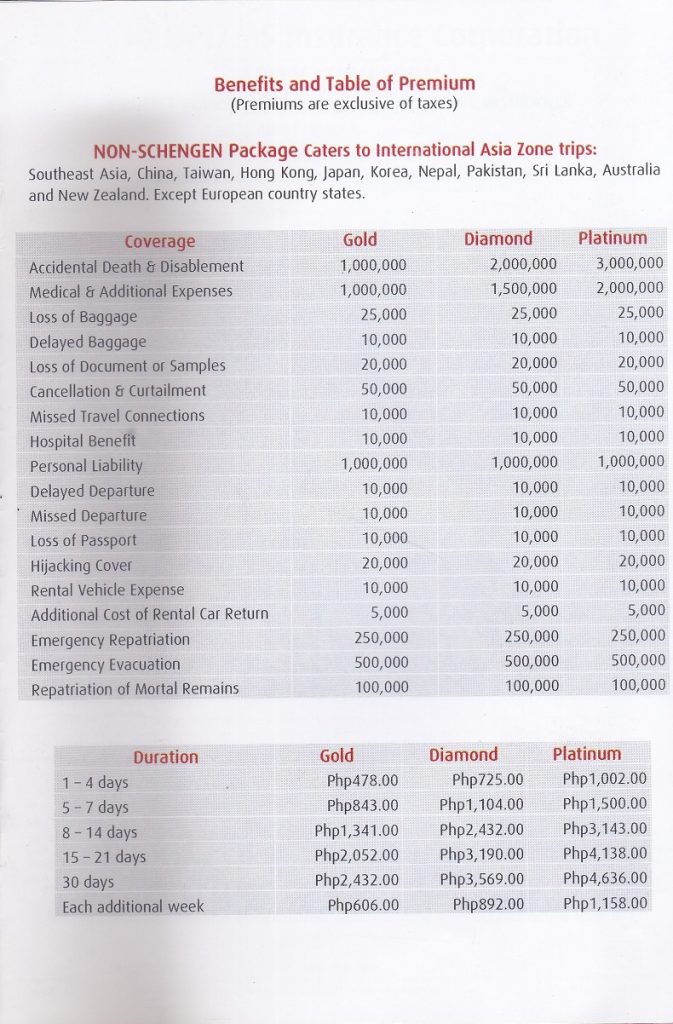

| Pacific Cross | $50,000 | $50,000 | Yes | $30/month | 4.5/5 |

| AXA | $100,000 | $75,000 | Yes | $40/month | 4.6/5 |

| InsureMyTrip | $75,000 | $75,000 | Yes | $35/month | 4.4/5 |

How to Choose the Best Travel Insurance

1. Assess Your Needs

Consider factors like your travel destination, activities planned, and personal health conditions. For example, I once traveled to Palawan and signed up for adventure sports coverage, which proved invaluable when I decided to go scuba diving.

2. Read the Fine Print

Understand what is included and what is excluded. Pay attention to clauses regarding pre-existing conditions and high-risk activities.

3. Compare Options

Use comparison websites or consult an insurance advisor to determine the best options that match your needs.

4. Check Reviews

Read customer reviews on platforms like Trustpilot and eCommerce sites to gauge the reliability of the insurance provider. Trust me, experiencing poor customer service after an accident can be incredibly frustrating.

Personal Travel Experience: Why I Never Travel Without Insurance

On my trip to Cebu last year, I forgot my camera at a local restaurant. Thankfully, I had travel insurance that covered lost belongings. After a few phone calls and paperwork, the insurance helped me replace my lost items. This experience solidified my belief in the importance of having adequate travel insurance.

Travel Tips for Choosing Insurance in the Philippines

1. Understand Local Regulations

Some travel agencies in the Philippines require proof of insurance to book tours and activities—check before you go!

2. Use Credit Cards Wisely

Some credit cards offer travel insurance as part of their benefits. Ensure to read the details to see if it suffices for your trip.

3. Contact Your Provider

If you encounter issues while traveling, knowing how to contact your insurance provider is crucial. Save their contact details on your phone.

Destination Highlights That Require Insurance

1. Palawan

Known for its breathtaking beaches and lagoons, Palawan is a must-visit. Keep in mind that traveling through remote areas may require extra coverage.

2. Boracay

Famous for its white sandy beaches, Boracay is bustling with activities. Insurance is essential for water sports and potential cancellations due to weather.

3. Davao

Tour the beautiful landscapes of Davao, but make sure you’re covered, especially when visiting Mount Apo or other adventure sites.

Pros and Cons of Travel Insurance

Pros

- Peace of Mind: Knowing you are covered in unforeseen situations.

- Financial Protection: Saves you from unexpected expenses.

- 24/7 Assistance: Access to help when you need it the most.

Cons

- Costs: Insurance can be an additional expense.

- Complex Terms: Policies can have complicated language that is hard to understand.

FAQs About Travel Insurance in the Philippines

1. Do I really need travel insurance for the Philippines?

Travel insurance is highly recommended, especially for international travelers and those engaging in activities like scuba diving or hiking.

2. How much does travel insurance cost in the Philippines?

The cost varies based on coverage, duration, and your age. On average, expect to pay between $30 to $100 for a single trip.

3. Are pre-existing conditions covered by travel insurance?

This depends on the provider and the specific policy. Always check for exclusions regarding pre-existing conditions.

4. When should I purchase travel insurance?

It’s best to buy insurance as soon as you book your trip to cover any cancellation fees or unforeseen circumstances.

5. Can I get travel insurance after I arrive in the Philippines?

While it’s possible, it’s not advisable because you won’t be covered for any incidents that occur before purchasing the insurance.

Conclusion: Travel Smart with Insurance

Traveling to the Philippines can be one of the most memorable experiences of your life. However, ensuring you have the right travel insurance can provide peace of mind and financial security if things go awry. Take the time to compare options, read reviews, and choose a policy that meets your specific needs. As you set out to explore the stunning landscapes and vibrant culture of the Philippines, remember that being prepared is part of the adventure. Happy travels!