Traveling is one of life’s greatest joys, but it often comes with its own set of challenges and uncertainties. As a seasoned traveler, I’ve faced my share of unexpected events, from flight cancellations to lost luggage, all of which reminded me of the importance of travel insurance. In this comprehensive guide, we’ll dive deep into travel insurance provided by Seven Corners, exploring how it can ensure your peace of mind while exploring the world.

What is Travel Insurance?

Travel insurance is a type of insurance designed to protect travelers against lost belongings, health emergencies, trip cancellations, and other unforeseen events. It can cover various issues that may arise before or during your trip, giving you peace of mind and allowing you to focus on enjoying your travels.

The Importance of Travel Insurance

Imagine you’re on your dream vacation, and suddenly, you fall ill or your flight is canceled due to unforeseen circumstances. Without travel insurance, these events can lead to substantial financial losses and a lot of stress. Here are a few key reasons why travel insurance is essential:

- Financial Protection: Covers unexpected expenses due to cancellations or medical emergencies.

- Peace of Mind: Allows you to enjoy your trip without worrying about what may go wrong.

- Emergency Assistance: Provides support during emergencies, helping you navigate through challenges.

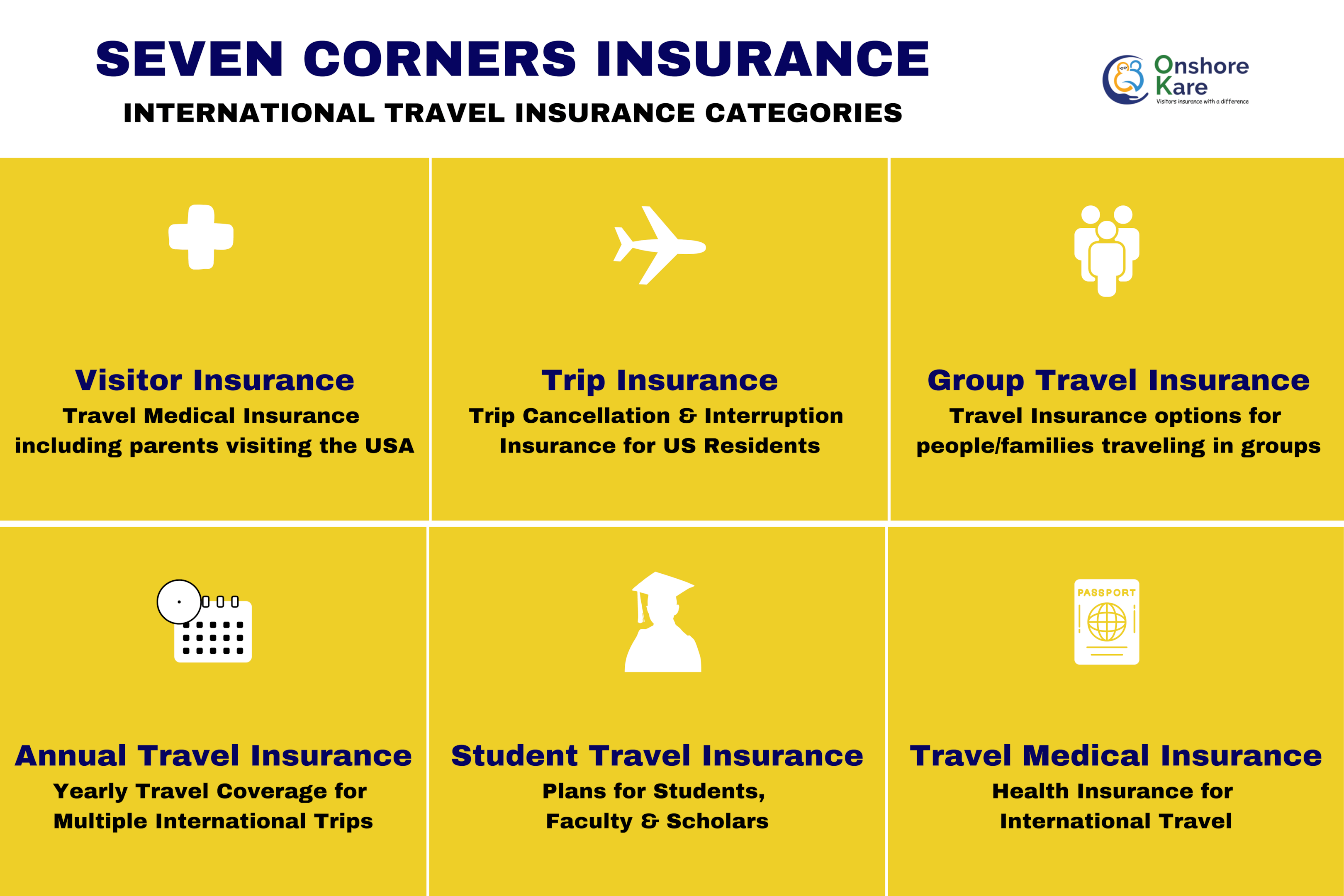

Introducing Seven Corners Travel Insurance

Seven Corners is a renowned provider of travel insurance known for its comprehensive coverage options and excellent customer service. With a variety of plans tailored to meet different travel needs, they offer packages for travelers, expatriates, and even international students.

Key Features of Seven Corners Travel Insurance

When exploring Seven Corners, numerous features stand out:

- Customizable Plans: Tailor your travel insurance based on your specific needs, whether for a leisure trip or a longer stay abroad.

- 24/7 Emergency Support: Access to assistance anytime, anywhere, ensuring you have help when you need it.

- Comprehensive Coverage: Options for trip cancellation, medical emergencies, lost luggage, and more.

Comparison of Seven Corners Plans

| Plan Name | Coverage Type | Emergency Medical Coverage | Trip Cancellation | Cost (Approx.) |

|---|---|---|---|---|

| Travel Medical Insurance | Medical Emergencies | $100,000 | Not Included | $42/month |

| Trip Cancellation Insurance | Trip Cancellations | Not Included | Up to 100% of trip cost | $35/month |

| Comprehensive Travel Insurance | Medical, Trip Cancellations | $250,000 | Up to 100% of trip cost | $79/month |

Personal Experience: Why I Chose Seven Corners

During a recent trip to Europe, I faced an unexpected challenge. My flight was canceled due to severe weather conditions, and I was left scrambling to rearrange my travel plans. Thankfully, I had opted for Seven Corners travel insurance. Their customer service was incredibly responsive, guiding me through the process of filing my claim. Ultimately, I was reimbursed for the extra hotel nights I had to book, which turned a stressful situation into a manageable one. This experience solidified my trust in Seven Corners as my go-to travel insurer.

Pros and Cons of Seven Corners Travel Insurance

Pros

- Wide range of customizable plans to fit different travel needs.

- Excellent customer service with 24/7 support.

- Comprehensive coverage options that protect against many travel mishaps.

Cons

- Some plans may be more expensive compared to other providers.

- Coverage limits may not be adequate for high-risk adventure sports.

Tips for Choosing the Right Travel Insurance

Choosing the right travel insurance can feel overwhelming, but it doesn’t have to be. Here are some tips to help you select the best coverage for your needs:

- Assess Your Travel Needs: Consider the nature of your trip, your health, and any activities you plan to do.

- Read Reviews and Ratings: Look up reviews from reputable sources to find the best policy for you.

- Compare Plans: Use comparison tools to analyze several insurance plans to find the best coverage for your budget.

Destination Highlights: Travel Insurance for Diverse Adventures

Whether you’re embarking on a relaxing beach vacation or an adventurous mountain trek, having the right travel insurance is crucial. Let’s explore a few destinations where travel insurance is a must-have:

1. Tropical Getaways

When traveling to tropical locations, consider coverage for health risks like dengue fever or Zika virus. Seven Corners provides plans that cover medical emergencies in such regions.

2. Skiing Trips

If you plan to hit the slopes, make sure your insurance covers skiing and other adventurous activities. Seven Corners offers specialized plans for sports injuries that may occur during winter sports.

3. International Backpacking

Traveling through multiple countries can lead to various challenges, from passport issues to sudden medical needs. Choose an extensive plan for maximum protection during your backpacking journey.

SEO Keyword Research Insights

After analyzing the top-ranking articles on travel insurance, here are some additional keywords and phrases that can enhance your article:

- Best travel insurance for international travel

- Travel insurance tips for frequent travelers

- Understanding travel insurance claims process

- Travel insurance provider reviews

FAQs about Seven Corners Travel Insurance

1. What does Seven Corners travel insurance cover?

Seven Corners travel insurance usually covers medical emergencies, trip cancellations, lost luggage, and emergency evacuation, among other travel-related incidents.

2. How do I file a claim with Seven Corners?

You can file a claim online through their website, where you’ll find detailed instructions and customer service support to assist you with the process.

3. Is Seven Corners travel insurance worth the cost?

Many travelers find the peace of mind and financial protection during unexpected situations to be worth the investment in Seven Corners travel insurance.

4. Can I purchase travel insurance for a single trip?

Yes! Seven Corners offers both single trip and annual plans, so you can choose the one that best fits your travel habits.

5. Are pre-existing conditions covered by Seven Corners travel insurance?

Coverage for pre-existing conditions can vary by plan; it’s essential to carefully read the policy details or speak with customer service for clarification.

Conclusion: The Assurance of Traveling with Seven Corners

As you venture out into the world, having the protection of travel insurance, particularly through a reliable provider like Seven Corners, can make all the difference in your experience. I strongly recommend investing in travel insurance for every journey, as it not only safeguards your financial well-being but also allows you to travel with confidence and peace of mind. With reliable service, multiple coverage options, and a commitment to customer care, Seven Corners could very well be your companion in every adventure ahead.

Final Thoughts on Travel Ease

No one wants to envision the worst while planning a trip, but being prepared with the right travel insurance can be the difference between a great experience and a stressful one. I hope this guide has illuminated the importance of travel insurance and why Seven Corners may be the right choice for you. Where will your next adventure take you?