Travel is one of life’s greatest pleasures, but it can also be unpredictable. That’s where travelers insurance comes into play. In this ultimate guide, we’ll walk you through the travelers insurance application process, share personal experiences, and help you choose the best insurance options for your next adventure.

What is Travelers Insurance?

Travelers insurance is a type of coverage that protects you against various unforeseen events while traveling. This can include trip cancellations, medical emergencies, lost luggage, and more. Whether you’re planning a weekend getaway or an international expedition, having the right coverage can provide peace of mind.

Why You Need Travelers Insurance

Protection from Unexpected Events

Imagine you’re on a dream vacation in Bali, and a sudden illness strikes. Without travelers insurance, you may face exorbitant medical costs. My friend Sarah learned the hard way when she had to pay out-of-pocket for an emergency room visit during her trip to Thailand.

Trip Cancellation Coverage

Canceling a trip can be costly, especially if you’ve already paid for flights and accommodations. I once had to cancel a planned excursion to Italy due to a family emergency. Thanks to the insurance I had, I was reimbursed for most of my costs.

Peace of Mind

Having insurance means that you can fully enjoy your travel experience without constantly worrying about the “what ifs.” I remember feeling much more relaxed knowing I had coverage during my hiking trip in the Andes.

Types of Travelers Insurance

Trip Cancellation Insurance

This type of insurance is designed to reimburse you for non-refundable expenses if you need to cancel your trip for an insured reason.

Medical Insurance

Medical travelers insurance provides coverage for medical expenses incurred while traveling, especially important for international travel.

Emergency Evacuation Insurance

This covers costs associated with an emergency evacuation from a remote location to a medical facility.

Coverage for Lost or Stolen Items

This type of insurance offers reimbursement for lost, stolen, or damaged luggage or personal belongings.

How to Apply for Travelers Insurance

Step 1: Research Different Plans

Before applying, evaluate different insurance providers and their plans. Websites like InsureMyTrip and Squaremouth can help you compare coverage options and prices.

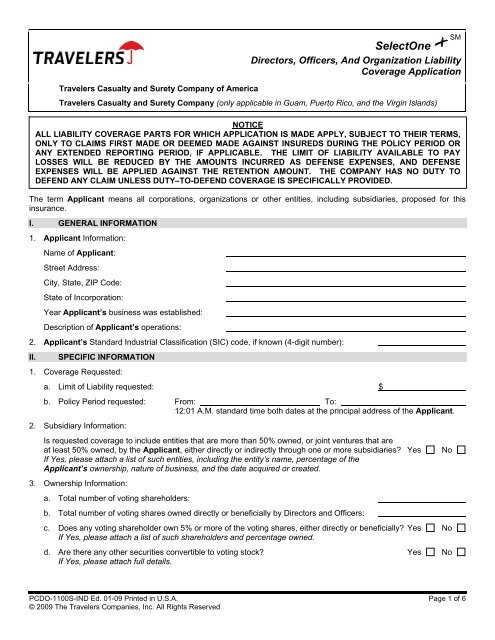

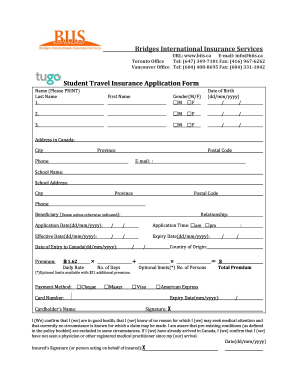

Step 2: Gather Required Information

When applying, you’ll typically need to provide:

- Your personal details (name, date of birth, etc.)

- Details of your trip (destination, dates, itinerary)

- Any pre-existing medical conditions

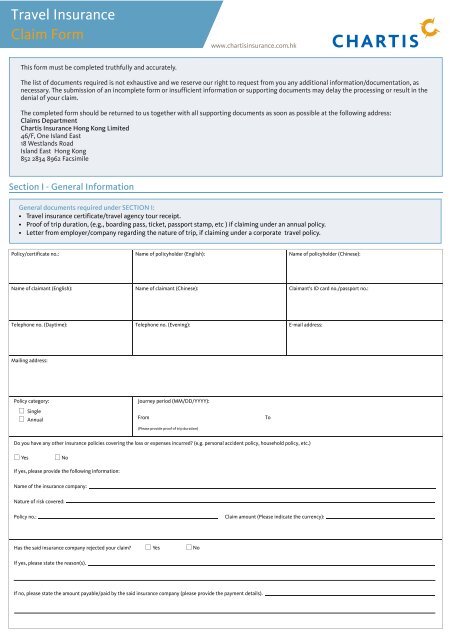

Step 3: Fill Out the Application Form

Once you’ve chosen a provider, fill out the application form carefully. Ensure that all information is accurate, especially regarding your travel dates and health conditions.

Step 4: Review the Policy

Before finalizing your application, thoroughly review the policy. Look for exclusions and limitations that may affect your coverage.

Step 5: Make the Payment

After you review your policy, complete the payment process. Keep a copy of your policy document accessible during your trip.

Comparison of Top Travelers Insurance Providers

| Provider | Coverage Type | Customer Rating | Price Range |

|---|---|---|---|

| Allianz Global Assistance | Comprehensive | 4.5/5 | $50-$150 |

| Travel Guard | Medical, Cancellation | 4.4/5 | $45-$200 |

| World Nomads | Adventure, Medical | 4.6/5 | $60-$300 |

| InsureMyTrip | Custom Plans | 4.3/5 | $40-$120 |

Pros and Cons of Travelers Insurance

Pros

- Financial protection against unexpected events

- Peace of mind while traveling

- Access to 24/7 assistance

Cons

- Additional cost added to travel budget

- Coverage limitations and exclusions

- Potential difficulty in claiming reimbursements

Travel Tips: How to Choose the Best Travelers Insurance

Assess Your Needs

Consider the type of trip you’re taking. Are you going on a hiking adventure or a laid-back beach holiday? My mountain hiking experience in Patagonia made me realize the importance of specialized coverage for high-risk activities.

Read Reviews and Ratings

Take the time to read reviews on sites like Trustpilot and Consumer Affairs to see what real customers are saying.

Ask Questions

Don’t hesitate to reach out to insurance providers with questions. Understanding every detail of your policy is crucial.

Check for Discounts

Many providers offer discounts for group policies or bundled travel services. During my last trip, I saved money by combining my travel insurance with an airline ticket.

Destination Highlights: Travelers Insurance by Region

Europe

Traveling in Europe can be pricey, and having insurance is a must. Countries like France and Italy have high medical costs. I once visited Paris and suffered a minor injury; thankfully, my insurance covered my doctor’s visit.

Asia

In Asia, the risks may include health issues and lost items. Having a comprehensive policy is advisable. On my trip to Japan, I was covered against unexpected travel delays due to typhoons.

North America

The USA has sky-high healthcare costs, making medical insurance essential. I had a friend who fell ill in New York and ended up with an astronomical hospital bill without insurance.

South America

Adventurous travelers often visit South America for its natural wonders. During my trek to Machu Picchu, the peace of mind from my insurance allowed me to fully enjoy the breathtaking views without worry.

FAQs About Travelers Insurance

What does travelers insurance cover?

Travelers insurance typically covers trip cancellations, medical emergencies, lost luggage, and other unexpected events while traveling. It’s vital to read your policy to understand specific coverage options.

Is travelers insurance worth it?

Yes, especially if you’re traveling internationally or planning activities that may involve risks. Having insurance can save you money and give you peace of mind.

Can I purchase travelers insurance after booking my trip?

Yes, travelers insurance can usually be purchased up to the day before your trip, though it’s best to buy it shortly after booking.

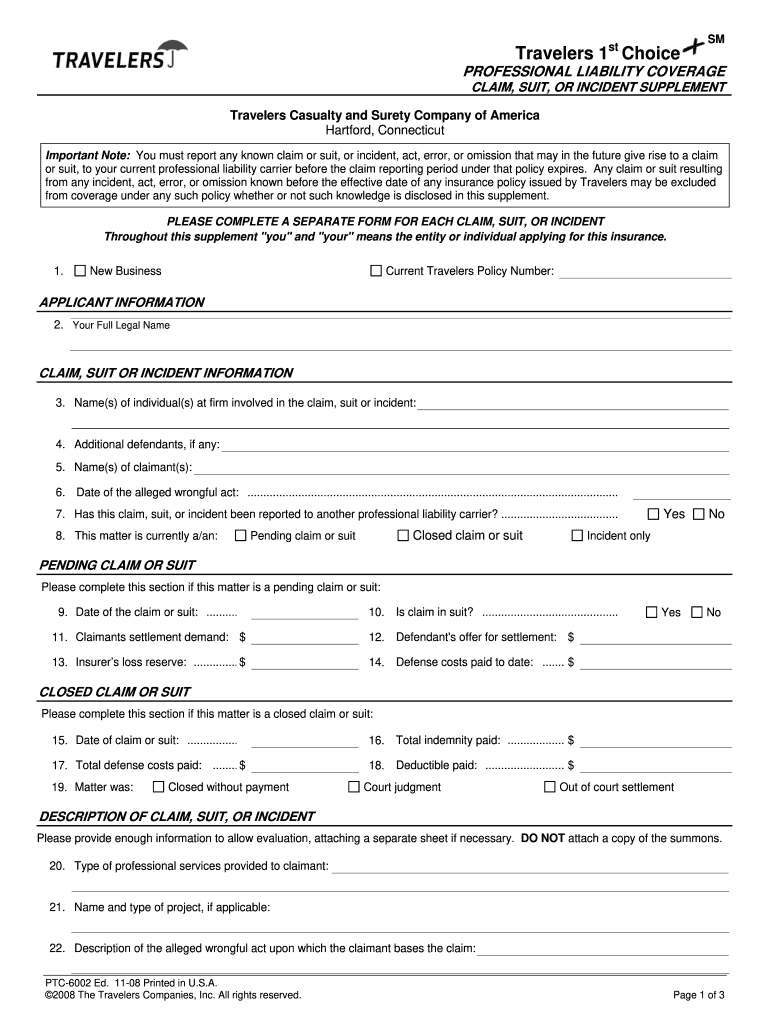

How do I file a claim?

Each insurance provider has a specific process for filing claims. Generally, you’ll need to gather all supporting documents and submit them according to your provider’s guidelines.