As a travel enthusiast who’s always on the lookout for new experiences, visiting Long Beach, California, can be an exciting venture. With its stunning coastline, vibrant culture, and rich history, this city is indeed a gem on the Pacific coast. However, as with any travel destination, understanding the local sales tax can enhance your travel experience by avoiding unexpected costs. Here, we’ll dive deep into the sales tax specifics of Long Beach, CA, giving you not only the practical information you need but also some personal insights into this beautiful coastal city.

What is Sales Tax in Long Beach, CA?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. In Long Beach, as part of California’s statewide sales tax laws, the sales tax rate comprises both state and local taxes.

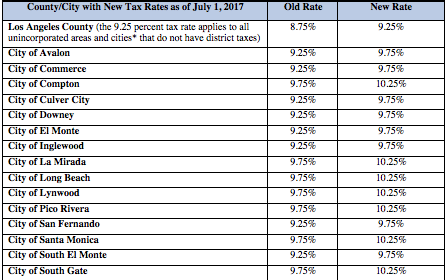

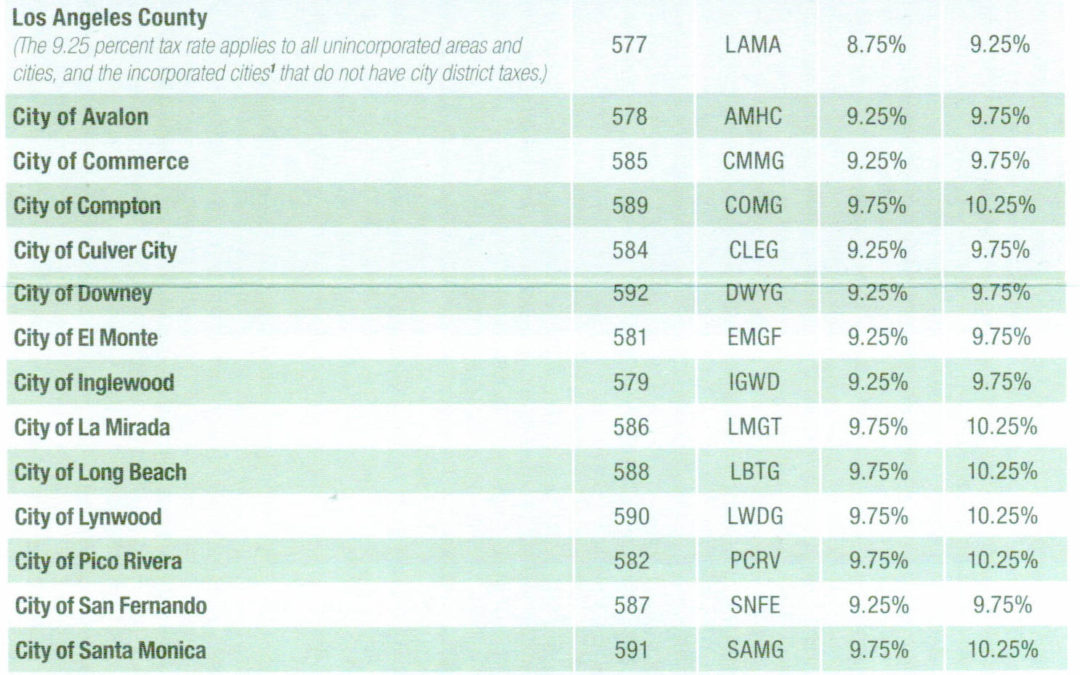

Current Sales Tax Rate in Long Beach

As of 2023, the total sales tax rate in Long Beach, California, is 10.25%. This rate is made up of:

- California state sales tax: 7.25%

- Los Angeles County sales tax: 2.25%

- City of Long Beach sales tax: 1.00%

Sales Tax Breakdown

| Tax Type | Percentage |

|---|---|

| State Sales Tax | 7.25% |

| County Sales Tax | 2.25% |

| City Sales Tax | 1.00% |

| Total Sales Tax | 10.25% |

Why is Sales Tax Important for Travelers?

Understanding sales tax is crucial for budgeting your trip. When traveling, the last thing you want is to encounter unexpected charges that can ruin your travel plans. Whether you’re dining out, shopping for souvenirs, or enjoying local attractions, sales tax can significantly affect your overall expenses.

My Personal Experience with Sales Tax in Long Beach

During my trip to Long Beach last summer, I eagerly anticipated splurging on local delicacies and unique finds at the local markets. Little did I know, the additional sales tax on my purchases would be a noticeable part of my spending. For example, when I bought a beautiful handcrafted souvenir, I had to keep that 10.25% in mind when calculating my budget. However, understanding this upfront helped me enjoy my experience without feeling financially blindsided.

How Sales Tax Affects Different Purchases

Food and Beverage

Restaurants in Long Beach are subject to sales tax on the value of meals sold, which means you’ll pay sales tax on your dining experiences. Keep this in mind when budgeting for food.

Average Costs

Dining out can vary significantly, but here’s a rough estimate based on my experiences:

| Item | Average Cost | Sales Tax (10.25%) | Total Cost |

|---|---|---|---|

| Lunch | $15.00 | $1.54 | $16.54 |

| Dinner | $30.00 | $3.08 | $33.08 |

Shopping for Souvenirs

When purchasing souvenirs or gifts, remember that the sales tax will add to the flat rate. Local shops offer unique crafts and memorabilia, making them a must-visit. Planning out your budget for these items is essential.

Shopping Tips

- Look for stores that advertise tax-free weekends.

- Check if any items are exempt from sales tax (like clothing under $110).

- Keep receipts for larger purchases, as you may need them for returns or exchanges.

Taxes on Accommodation

If you’re staying in hotel accommodations, be mindful that hotels in Long Beach also charge a Transient Occupancy Tax (TOT) along with regular sales tax. This tax can add an additional 12% to your hotel bill.

Sample Hotel Cost Breakdown

| Hotel Stay (1 Night) | Room Rate | Sales Tax (10.25%) | Transient Occupancy Tax (12%) | Total Cost |

|---|---|---|---|---|

| Standard Room | $150.00 | $15.38 | $18.00 | $183.38 |

Travel Tips for Visitors

1. Plan Your Budget

Before your trip, create a budget that includes estimated sales tax. This will help you avoid overspending and ensure a smoother experience.

2. Use Cash for Smaller Purchases

Using cash can help you keep better track of your spending, especially for smaller purchases where the sales tax might not be immediately obvious.

3. Take Advantage of Deals

Look for local promotions that might offset your costs, such as restaurants offering specials or shops providing discounts.

Destination Highlights: What to See and Do in Long Beach

While you navigate the sales tax landscape, don’t miss out on the incredible sights Long Beach has to offer. Here are some must-visit destinations.

1. The Queen Mary

The iconic Queen Mary is a floating hotel and museum that captures the essence of maritime history. It’s a great location for both exploration and dining.

2. Long Beach Aquarium of the Pacific

Immerse yourself in the wonders of the ocean at this engaging aquarium. It’s not only educational but also a delight for both kids and adults.

3. Shoreline Village

With its vibrant shopping options, restaurants, and stunning waterfront views, Shoreline Village is the perfect place to spend an afternoon.

Pros and Cons of Traveling to Long Beach, CA

Pros

- Diverse culinary experiences.

- Rich cultural and historical attractions.

- Beautiful beaches and outdoor activities.

- Convenient location near Los Angeles.

Cons

- Higher sales tax compared to other regions.

- Traffic congestion during peak tourist seasons.

- Parking can be challenging in busy areas.

Frequently Asked Questions

What is the sales tax rate in Long Beach, CA?

The sales tax rate in Long Beach, CA, is 10.25% as of 2023.

Are food purchases taxed in Long Beach?

Yes, food purchased at restaurants is subject to sales tax in Long Beach.

Is there a tax-free shopping day in California?

California does not have a statewide tax-free shopping day, but local promotions might occur.

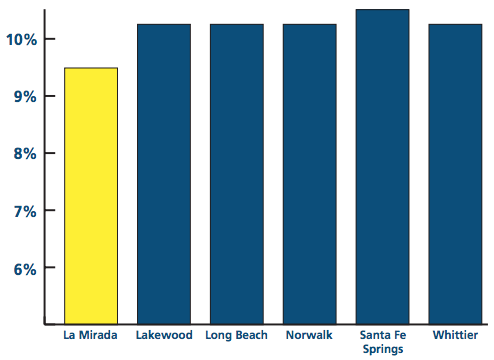

How does the sales tax compare to other cities in California?

Long Beach’s sales tax of 10.25% is on par with other major cities like Los Angeles but higher than some smaller cities.

Conclusion

Long Beach, California, is a delightful destination filled with exciting sights and experiences. While understanding the sales tax can help you budget more effectively and enhance your travel experience, there’s nothing quite like the thrill of exploring this vibrant coastal city. Your adventures await—whether you’re dining in a historic restaurant, finding unique souvenirs, or soaking up the sun on the beach. Safe travels!