When traveling to new places, understanding the local laws and regulations can enhance your experience. One often-overlooked aspect is sales tax. If you’re planning a trip to Long Beach, California, you’re in for a treat! This sunny coastal city offers stunning beaches, vibrant culture, and an array of shopping experiences. But before you hit the stores, let’s dive deep into what you need to know about sales tax in Long Beach, CA, and how it might affect your travel plans.

What is Sales Tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. It’s typically calculated as a percentage of the purchase price and is added at the point of sale. This means that when you buy a souvenir or dine at a local restaurant in Long Beach, an additional charge will be included in your bill.

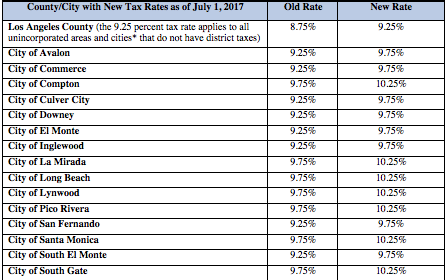

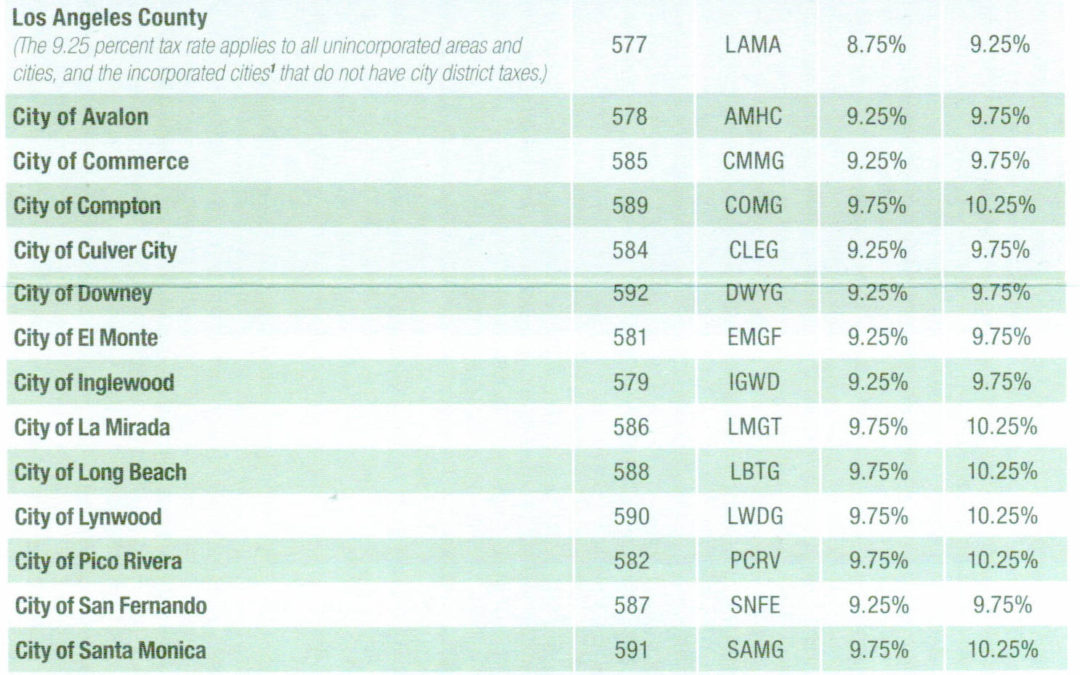

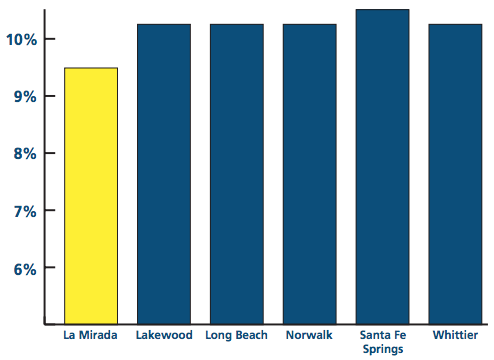

Sales Tax Rate in Long Beach, CA

The current sales tax rate in Long Beach is 10.25%. This includes both the state and local tax components. California as a state has some of the highest sales tax rates in the nation, and Long Beach is no exception. It’s important to be aware of this rate as you plan your budget for shopping and dining out.

Breakdown of Sales Tax in Long Beach

- State Tax: 7.25%

- County Tax: 0.25%

- City Tax: 2.75%

Why is Sales Tax Important for Travelers?

As a traveler, understanding the sales tax rate can help you budget more accurately. Here’s why it matters:

- Budgeting: Knowing the additional costs can prevent overspending.

- Shopping: Some items might be tax-exempt, so it’s good to understand what you can save on.

- Dining Out: Tax adds up when dining, so being informed means you can tip more generously without breaking the bank.

Shopping in Long Beach: Tips for Travelers

Long Beach boasts a variety of shopping options, from trendy boutiques to large retail chains. To make the most of your shopping experience, here are some helpful tips:

1. Explore Local Markets

Visiting local markets can be a fantastic way to avoid tourist traps and discover unique items. Places like the Long Beach Farmers Market offer local produce, crafts, and more without the hefty sales tax. Note that groceries can be exempt from sales tax in California!

2. Check for Sales Events

Many stores in Long Beach hold seasonal sales or promotional events. If you’re flexible with your shopping dates, timing your visit during these events can help you save on expenses.

3. Utilize Tax Refund Services

If you’re an international traveler, you may be eligible for refunds on sales tax through services that handle Tax-Free Shopping. It’s worth inquiring about this at larger retailers.

4. Be Mindful of Online Purchases

When shopping online, sales tax may not apply if the seller does not have a physical presence in California. However, if you’re picking up in-store, ensure to calculate the sales tax that will be added.

Pros and Cons of Sales Tax in Long Beach

Pros

- Infrastructure: Sales tax revenue helps fund important services like public transportation, schools, and healthcare.

- Local Economy Support: Higher local sales tax supports local businesses and public projects.

- Transparency: Knowing a fixed sales tax rate simplifies pricing and budgeting.

Cons

- Higher Costs: Sales tax can make everything from dining to shopping pricier than expected.

- Complexity: Travelers may find it challenging to calculate total costs effectively.

- Discouragement: High sales tax rates may deter some shoppers.

Travel Experiences in Long Beach

As someone who has had the pleasure of exploring Long Beach, I can vouch for its charm and vibrancy. Every corner of the city tells a story, and the local shopping scene is no different. Here are some of my favorite experiences:

Discovering Naples Island

During my visit, I stumbled upon Naples Island, a beautiful area with stunning canal views. Here, quaint shops offer a variety of goods, from artisan crafts to gourmet foods. I remember purchasing some locally made candles at a charming shop while enjoying the island’s picturesque scenery.

Queensway Bay Shopping Experience

Another highlight of my trip was exploring Queensway Bay. This waterfront area is not just about luxury shopping but also dining. I enjoyed a delicious meal at a local seafood restaurant, where I was pleasantly surprised by the reasonable prices, even with sales tax considered.

Comparative Table: Sales Tax Rates in Major California Cities

| City | Sales Tax Rate |

|---|---|

| Los Angeles | 9.50% |

| San Diego | 7.75% |

| San Francisco | 8.50% |

| Long Beach | 10.25% |

| Sacramento | 8.75% |

Frequently Asked Questions (FAQs) about Sales Tax in Long Beach, CA

1. What items are exempt from sales tax in Long Beach, CA?

Items like most groceries, prescription medications, and some types of clothing may be exempt from sales tax. Always check current California law for any specific exemptions.

2. Are tourist attractions subject to sales tax?

Yes, most attractions in Long Beach will charge sales tax on tickets. It’s wise to include this in your budget when planning visits to places like the Aquarium of the Pacific or Queen Mary.

3. Can I get a refund on sales tax paid during my visit?

International visitors may be eligible for sales tax refunds through tax-free shopping services; inquire at retailers for participation.

4. How is sales tax collected in Long Beach?

Sales tax is typically included in the advertised price and collected at the point of sale, whether in-store or online.

Conclusion

Understanding sales tax in Long Beach, CA, is vital for savvy travelers. While the 10.25% tax rate might seem high, knowing how it works and planning accordingly can enhance your experience. From budgeting for shopping excursions to knowing about potential exemptions, being informed puts you in the driver’s seat. Don’t forget to explore the local shops, taste delicious food, and soak in the beautiful beach atmosphere that Long Beach has to offer!