When planning your trip to Redondo Beach, CA, understanding the local sales tax can enhance your travel experience. As someone who has enjoyed the sun, surf, and local culture of this beautiful coastal town, I can tell you that knowing the ins and outs of sales tax can save you money and help you budget your trip more effectively. Let’s dive into the details!

What is Sales Tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. In the United States, sales tax rates can vary from one jurisdiction to another, and Redondo Beach, located in Los Angeles County, is no exception.

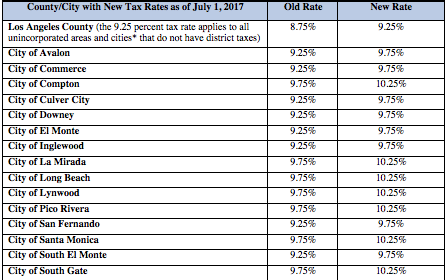

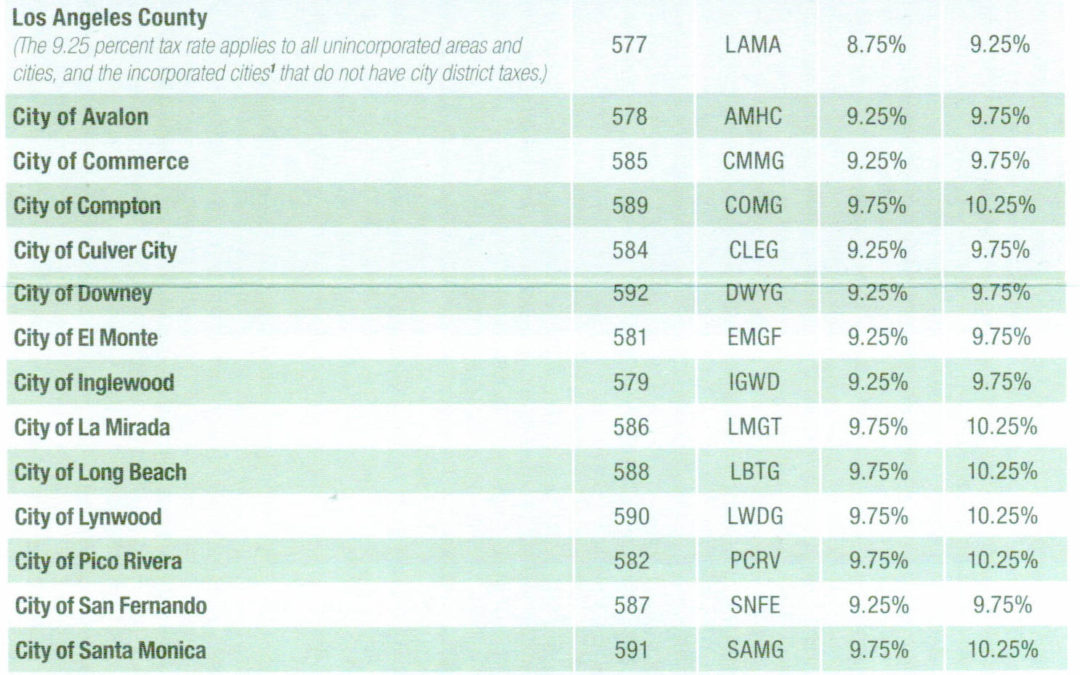

Current Sales Tax Rate in Redondo Beach, CA

The current sales tax rate in Redondo Beach is 10.25%. This rate is inclusive of the California state tax, local taxes, and district taxes. Understanding this tax rate is crucial when planning your trips, including dining, shopping, and other activities.

| Tax Type | Rate (%) |

|---|---|

| State Sales Tax | 7.25 |

| Local Sales Tax | 2.00 |

| District Tax | 1.00 |

| Total Sales Tax | 10.25 |

How Sales Tax Affects Travelers

For travelers, sales tax can impact your budget significantly. Whether you’re shopping for souvenirs, dining at a local restaurant, or renting equipment for water sports, it’s essential to factor in sales tax to avoid surprises.

Shopping in Redondo Beach

Redondo Beach has a wide array of shopping options, from local boutiques to big-name retailers. When budgeting for your shopping spree, consider the additional cost of sales tax.

Tips for Budget Shopping

- Always ask if there are any sales or discounts available.

- Factor in the sales tax when calculating your total budget for shopping.

- Explore local arts and crafts markets for unique items that support local artisans.

Dining Experiences and Sales Tax

Dining out is one of the highlights of any travel experience. In Redondo Beach, you can find a variety of dining options ranging from casual beachside cafes to high-end restaurants. Remember that sales tax will apply to your meals and drinks, so here are some travel tips to help you plan wisely.

Dining Tips for Tourists

- Check the menu for pricing before walking in; some restaurants may list prices excluding tax.

- Consider dining during happy hours for discounted prices.

- Leave room in your budget for gratuity, typically around 15-20% of your total bill.

Accommodation and Sales Tax

When booking your stay in Redondo Beach, keep in mind that hotel stays are also subject to sales tax. California imposes additional hotel taxes, so it’s prudent to understand what you’re paying for before confirming your reservation.

Understanding Hotel Taxes

The hotel tax rate in Redondo Beach can add an extra layer of cost to your stay. Typically, the accommodations tax in California can range from 12% to 15%, depending on the type of lodging and location.

Comparison of Accommodation Options

| Hotel Name | Average Nightly Rate | Sales Tax Rate | Total Cost (Excluding Tax) |

|---|---|---|---|

| The Portofino Hotel & Marina | $300 | 15% | $345 |

| Redondo Pier Inn | $150 | 12% | $168 |

| Best Western Plus | $180 | 12% | $202.50 |

Activities and Goods Subject to Sales Tax

When enjoying the many activities that Redondo Beach has to offer, it’s vital to know which services are subject to sales tax.

Common Activities in Redondo Beach

- Water Sports Rentals: Kayaks, paddleboards, and surfboards usually incur sales tax.

- Beach Equipment Rentals: Umbrellas and chairs rented on the beach are taxable.

- Local Tours: Guided tours often include sales tax in the total price.

Sales Tax on Entertainment

Movie theaters, amusement parks, and other entertainment venues may also include sales tax in ticket prices. Always check the fine print or inquire at the box office to avoid surprises!

Pros and Cons of Sales Tax in Redondo Beach

Pros

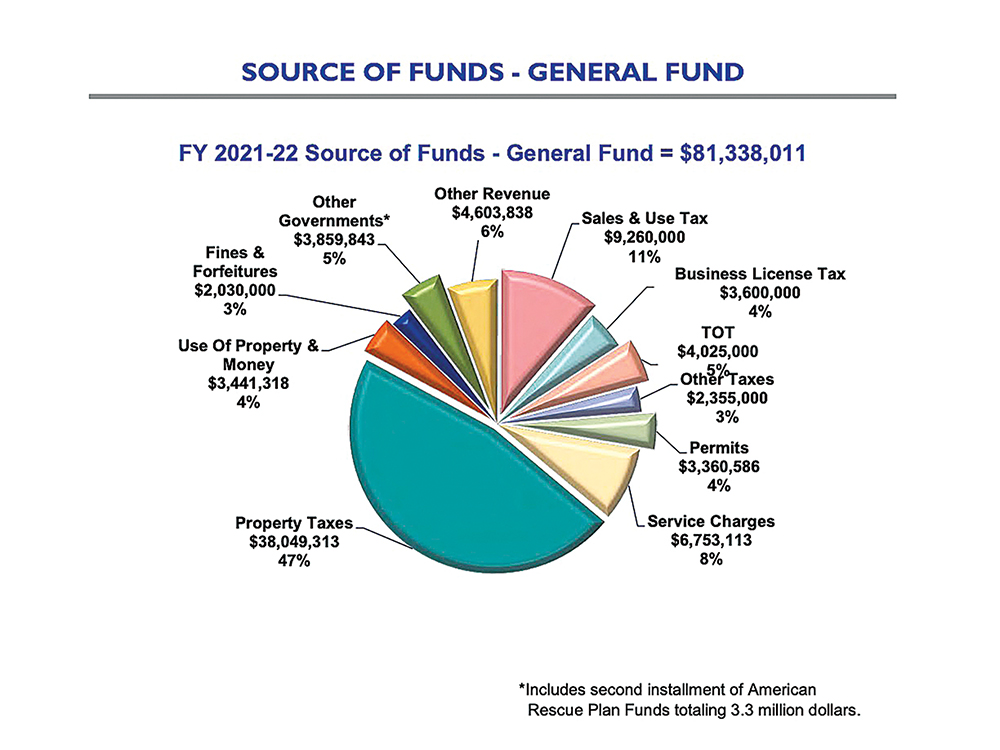

- Contributes to local infrastructure and public services that enhance the travel experience.

- Helps fund beach maintenance and preservation efforts.

- Encourages support for local businesses through shared tax contributions.

Cons

- Can add significant costs to vacation budgets.

- May be confusing for international travelers unfamiliar with U.S. sales tax.

- Variability in tax rates can create uncertainty in budgeting.

Frequently Asked Questions (FAQs)

What is the overall sales tax in Redondo Beach?

The overall sales tax in Redondo Beach, CA, is currently 10.25%.

Are there any exemptions from sales tax in Redondo Beach?

Yes, some items such as groceries and prescription drugs are exempt from sales tax in California.

How does sales tax apply to online purchases while in Redondo Beach?

If you purchase items from an online retailer based in California, you will likely be charged sales tax at the rate of 10.25%.

How can I keep track of sales tax expenses during my trip?

It’s best to maintain a travel budget that includes estimated sales tax on purchases and keep receipts for tracking your expenses.