Welcome to Palm Beach County, a breathtaking destination known for its stunning beaches, vibrant nightlife, and rich history. As you prepare for your Florida adventure, it’s essential to familiarize yourself with the sales tax rate in Palm Beach County, especially if you’re planning to shop for souvenirs, indulge in local delicacies, or try out the many exciting activities the area has to offer. In this comprehensive guide, we will break down everything you need to know about the sales tax rate, from current rates to tips on managing your budget effectively while enjoying your travels.

What is Sales Tax?

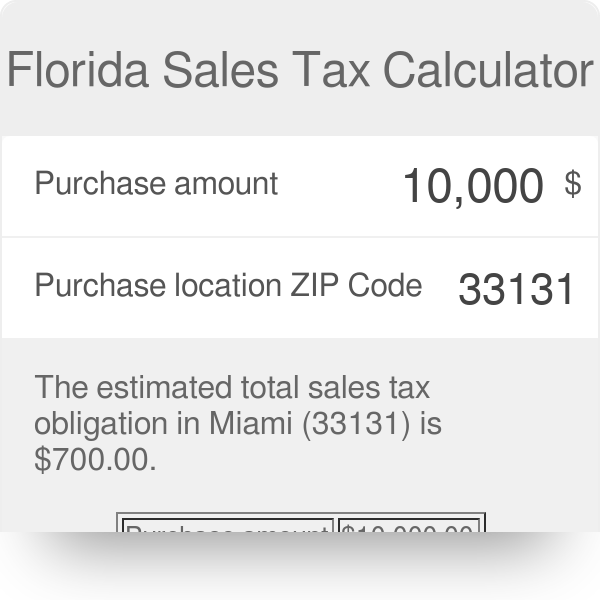

Sales tax is a consumption tax imposed by the government on the sale of goods and services. It’s calculated as a percentage of the sale price and is typically added at the point of purchase. In Florida, sales tax rates can vary by county, making it important to understand the specific rates applicable to the areas you visit.

Current Sales Tax Rate in Palm Beach County

As of October 2023, the sales tax rate in Palm Beach County is 7.0%. This rate is comprised of the base Florida state sales tax rate of 6.0% and a local option sales tax of 1.0%.

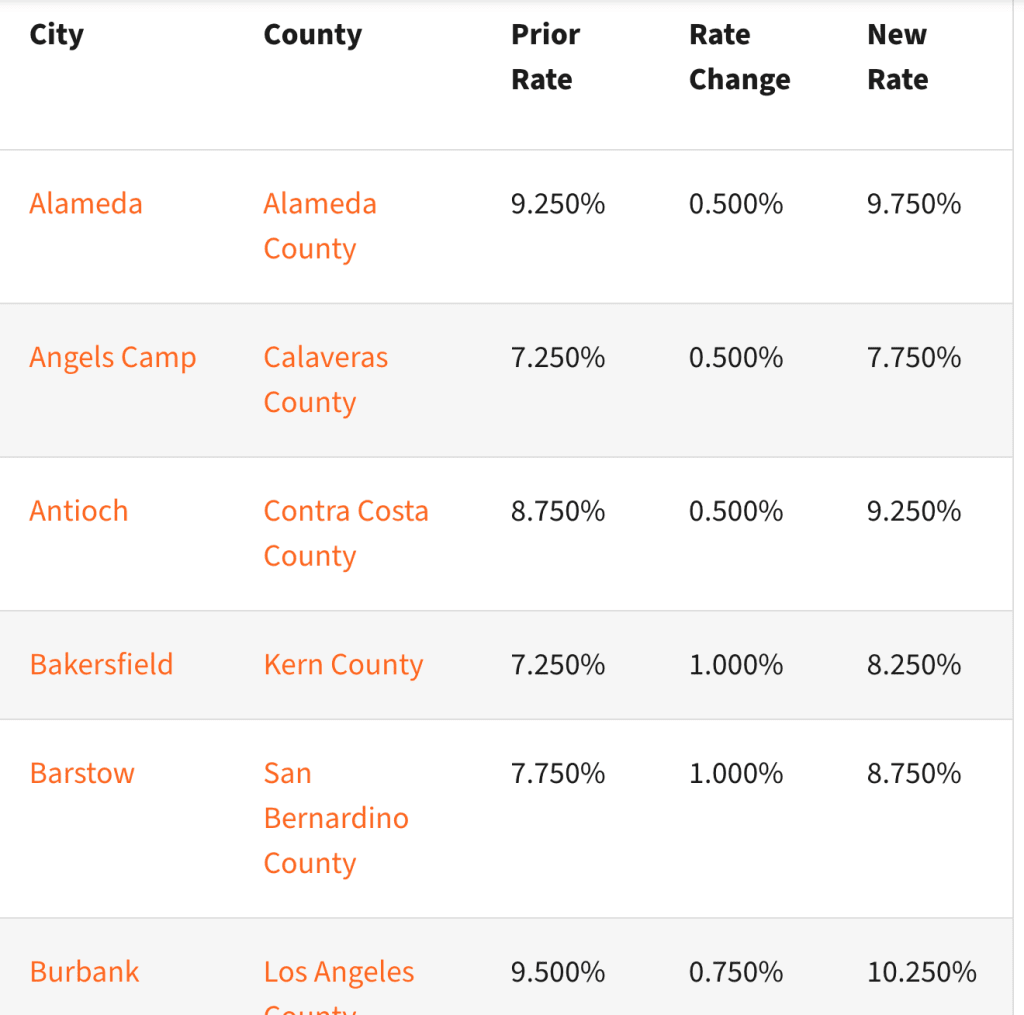

Comparing Sales Tax Rates in Florida Counties

| County | Sales Tax Rate |

|---|---|

| Miami-Dade | 7.0% |

| Broward | 6.0% |

| Orlando | 6.5% |

| Monroe | 7.5% |

| Palm Beach | 7.0% |

Tips for Managing Sales Tax While Traveling

When traveling, it’s easy to overlook the additional costs associated with sales tax. Here are some practical tips to help you manage your budget effectively:

- Plan Your Purchases: Make a list of items you want to buy and research their prices beforehand.

- Check for Discounts: Some stores may offer discounts or tax holidays, so keep an eye out for promotions.

- Track Your Expenses: Keep a record of your purchases to better understand how much tax you are paying.

- Explore Local Markets: Sometimes local markets have prices that include tax, making it easier to manage your budget.

Personal Travel Experiences in Palm Beach County

Four years ago, I decided to take a solo trip to Palm Beach County. I still remember the excitement of strolling down Worth Avenue, the luxurious shopping street filled with high-end boutiques. At one shop, I picked up a beautiful sundress. I had calculated the cost beforehand, but I still gasped at the total when the sales tax was added — a gentle reminder of the importance of knowing your expenses!

Popular Shopping Areas in Palm Beach County

Worth Avenue

Known for its upscale shopping, Worth Avenue is a must-visit for those looking to splurge. With a variety of luxury brands alongside charming cafes, it’s the perfect spot for shopping lovers.

Downtown West Palm Beach

This vibrant area offers a mix of boutique shops, restaurants, and art galleries. Don’t miss the chance to explore Clematis Street, which frequently hosts events and live music.

Palm Beach Gardens Mall

For a more traditional shopping experience, the Palm Beach Gardens Mall hosts popular retail stores and dining options, plus it’s an indoor environment perfect for a hot Florida day.

Pros and Cons of Shopping in Palm Beach County

| Pros | Cons |

|---|---|

| Diverse shopping options | Higher prices compared to other counties |

| Unique local products | Sales tax can add up quickly |

| Stunning shopping environments | Limited discount options |

Understanding Tax Exemptions and Local Taxes

While the general sales tax applies, certain items may be exempt from sales tax in Florida. For example, groceries, prescription medication, and certain medical supplies are typically tax-exempt. This can help make your trip more affordable, especially if you plan on stocking up on groceries during your stay.

Temporary Sales Tax Holidays

Florida often holds temporary sales tax holidays. Attending during one of these periods can result in significant savings on back-to-school items, hurricane preparedness supplies, and more. Always check the Florida Department of Revenue for the exact dates and eligible items.

FAQs About Sales Tax Rate in Palm Beach County

1. What is the sales tax rate for online purchases in Palm Beach County?

The sales tax rate for online purchases is the same as in-person purchases at 7.0% as long as the retailer has a physical presence in Florida.

2. Are there any exemptions from sales tax in Palm Beach County?

Yes, certain items like groceries, medicine, and some medical supplies are exempt from sales tax in Florida, including Palm Beach County.

3. Can I get a refund on sales tax if I return an item?

If you return an item, the sales tax paid is typically refunded as part of the return process, but it may depend on the store policy.

4. How can I save on sales tax while shopping in Palm Beach County?

To save on sales tax, shop during tax holidays, look for sales promotions, or consider shopping at stores that offer tax-inclusive pricing.

5. Does the sales tax rate change in Palm Beach County?

Sales tax rates can change based on local legislative actions, but as of now, the Palm Beach County rate is stable at 7.0%.

Conclusion

Understanding the sales tax rate in Palm Beach County is crucial for any traveler looking to make the most of their trip. With a little planning and knowledge, you can navigate your shopping experiences while enjoying the beauty and excitement this area has to offer. Whether you’re visiting the luxurious shops of Worth Avenue or exploring local markets, being informed about local taxes will ensure that you enjoy your visit to the fullest without any unwelcome surprises.

Happy travels, and may you return home with wonderful memories and treasures from Palm Beach County!