As a frequent traveler and someone who has a fondness for beautiful coastal cities, Long Beach, California, holds a special place in my heart. With its stunning waterfront, vibrant arts scene, and rich history, it’s an ideal destination for anyone looking to explore the best of Southern California. However, before you pack your bags and head for the sunny shores, it’s essential to understand the financial aspects of your trip, including tax rates. In this comprehensive guide, we’ll dive into the various tax rates applicable in Long Beach, practical tips for budgeting your trip, and some personal experiences to make your travel planning easier.

Overview of Long Beach

Long Beach is located in Los Angeles County and is known for its beautiful beaches, diverse culture, and numerous attractions, such as the Queen Mary and the Aquarium of the Pacific. With close proximity to Los Angeles, it presents a less hectic alternative to the bustling city while still offering an exciting array of activities.

Tax Rates in Long Beach

Understanding the tax structure in Long Beach is crucial for budgeting your travel expenses. Here’s a detailed breakdown:

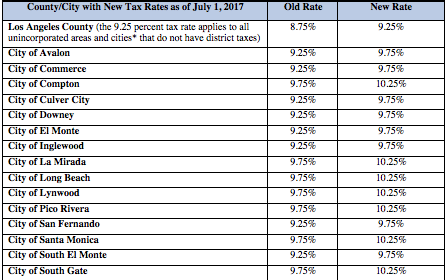

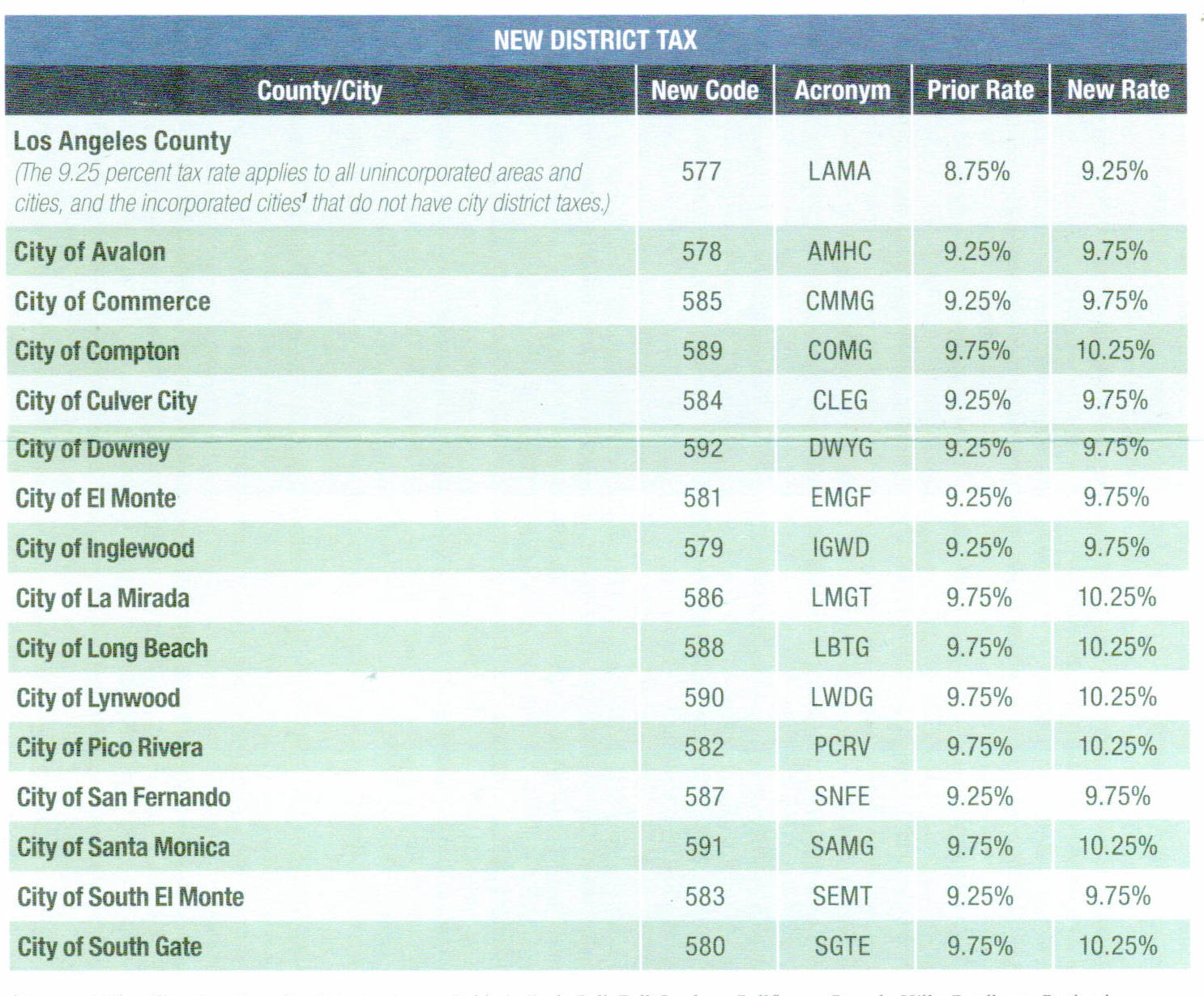

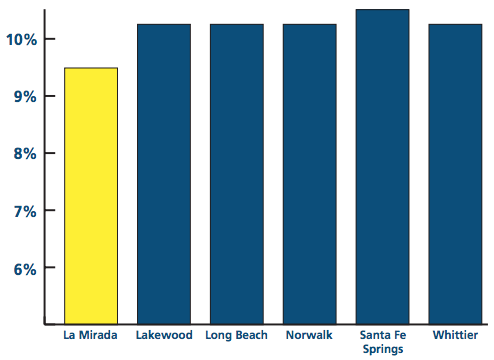

Sales Tax

The current sales tax rate in Long Beach is 10.25%. This rate is a combination of the California state tax of 7.25%, plus an additional 2% local tax.

| Type | Rate |

|---|---|

| California State Tax | 7.25% |

| Los Angeles County Tax | 2% |

| Total Sales Tax | 10.25% |

Property Tax

If you’re considering a longer stay or even relocating to Long Beach, be aware of the property tax rate. The average property tax rate in Long Beach is about 1.25% of the assessed value of the property.

Hotel Tax

Travelers staying in hotels will encounter a transient occupancy tax (TOT), which is currently set at 12% in Long Beach. This tax applies to all short-term rentals within the city.

Income Tax

For those working in Long Beach, California’s income tax ranges from 1% to 13.3% based on income brackets. It’s essential to account for this if you plan to work while visiting or relocating to the city.

Personal Travel Experience: Budgeting for My Long Beach Trip

On my last trip to Long Beach, I made a budget that included the local sales tax and hotel tax. Staying at a hotel along the waterfront was beautiful, but it also meant I had to account for the 12% tax on my nightly rate. Here’s how I broke down my expenses:

- Hotel Rate: $150/night

- Hotel Tax (12%): $18

- Total Cost: $168/night

This experience taught me that while Long Beach can be affordable, taxes can add up quickly if you don’t plan ahead!

Travel Tips for Long Beach

Plan for Taxes When Budgeting

Always account for sales and hotel taxes when estimating your daily spending in Long Beach. A little pre-planning will ensure you don’t overspend.

Take Advantage of Tax-Free Days

California occasionally offers tax-free days, particularly around major holidays. If your travel dates align, you could save significantly on purchases.

Explore Alternatives to Hotels

Consider renting an Airbnb or vacation home. While they may also be subject to the TOT, many offer competitive rates compared to hotels once you factor in taxes.

Destination Highlights in Long Beach

Long Beach is packed with attractions and activities that can appeal to varied interests. Here are some must-visit highlights:

The Queen Mary

The Queen Mary is a historic ocean liner that has been transformed into a hotel and museum. It’s a fascinating experience that combines history with luxury.

Visitor Rating: 4.4/5

Many visitors rave about the tours available, particularly the ghost tours that delve into the ship’s spooky past!

Aquarium of the Pacific

For marine life enthusiasts, the Aquarium of the Pacific is a treasure trove of vibrant sea life and interactive exhibits. Perfect for families!

Visitor Rating: 4.6/5

Visitors especially love the touch tanks and the immersive 3D theater experiences.

Long Beach Museum of Art

A haven for art lovers, this museum showcases California artists and offers beautiful views of the Pacific Ocean.

Visitor Rating: 4.5/5

The changing exhibitions and outdoor sculpture gardens are often highlighted as favorites among visitors.

Pros and Cons of Visiting Long Beach

Pros

- Beautiful beaches and warm weather.

- Diverse dining options and vibrant nightlife.

- Rich cultural attractions and activities for all ages.

- Proximity to Los Angeles and other Southern California attractions.

Cons

- Higher tax rates can add to your travel costs.

- Traffic can be heavy, especially during peak tourist season.

- Finding affordable accommodation can be challenging during events.

FAQs About Tax Rates in Long Beach

What is the total sales tax rate in Long Beach?

The total sales tax rate in Long Beach is 10.25%.

Are there any tax-free shopping days in California?

Occasionally, California holds tax-free days, particularly surrounding major holidays. Check the state’s announcements for specific dates.

How does the hotel tax affect my stay in Long Beach?

The transient occupancy tax (TOT) is 12% in Long Beach and is applied to all short-term rentals, significantly impacting your overall lodging costs.

What should I consider when budgeting for a trip to Long Beach?

When budgeting, account for sales tax, hotel tax, dining, attractions, and any transportation costs to get the most accurate estimate of your trip expenses.

Conclusion

Understanding tax rates in Long Beach is essential for making an informed budget for your travels. While the taxes can add to your expenditures, the beautiful landscapes, cultural experiences, and vibrant community make it worth every penny. With this guide, you’re now equipped to plan your perfect trip to Long Beach, California. Happy travels!