By [Your Name]

Introduction to Long Beach, CA

Long Beach, California, is a vibrant coastal city known for its stunning waterfront, diverse culture, and an abundance of activities. Whether you’re planning a trip for relaxation or adventure, there’s plenty to explore. As a travel enthusiast, I always find it essential to understand the financial aspects of my destination. One of the key components of shopping, dining, and entertainment during your visit is the sales tax rate. Let’s dive deep into the current sales tax rate in Long Beach and how it can affect your travel plans.

What Is the Current Sales Tax Rate in Long Beach, CA?

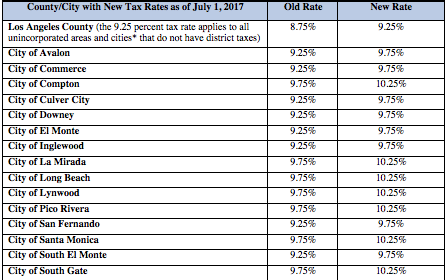

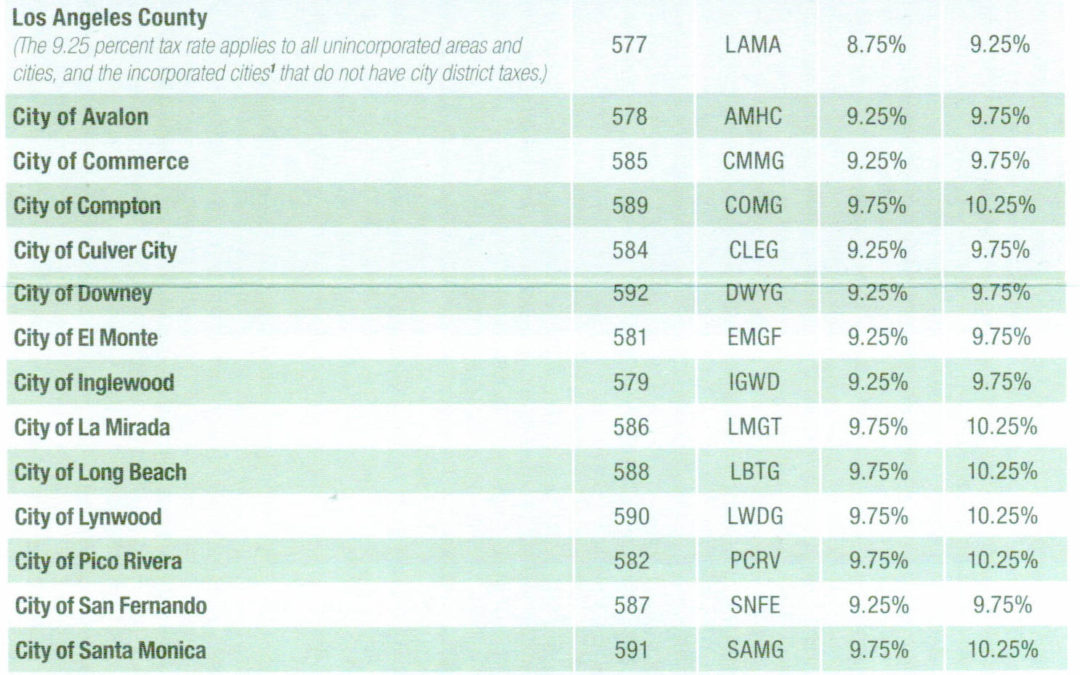

As of October 2023, the sales tax rate in Long Beach, CA, is 10.25%. This rate is inclusive of state, county, and city taxes. Understanding this rate is crucial for budgeting during your travels.

Breakdown of the Sales Tax Rate

Components of the Sales Tax

The sales tax rate is composed of several elements:

- California State Sales Tax: 7.25%

- Los Angeles County Rate: 2.0%

- Long Beach City Rate: 1.0%

This breakdown can help you understand how your spending contributes to local taxes and supports community services.

Travel Tips for Managing Sales Tax in Long Beach

Budgeting for Sales Tax

When planning your budget for Long Beach, always remember to factor in the sales tax. Here are some tips to manage your expenses:

- Set a Daily Spending Limit: Include sales tax when calculating your daily spending on food, shopping, or entertainment.

- Look for Tax-Free Days: Some retailers may offer tax-free shopping days or discounts.

- Keep Receipts: For any large purchases, keep your receipts in case you need to return items or want to keep track of your spending.

Comparing Sales Tax Across California Cities

Sales Tax Comparison Table

| City | Sales Tax Rate |

|---|---|

| Los Angeles | 9.5% |

| San Diego | 7.75% |

| San Francisco | 8.5% |

| Long Beach | 10.25% |

Personal Travel Experiences in Long Beach

During my recent trip to Long Beach, I thoroughly enjoyed the local cuisine and shopping. The sales tax became a point of consideration when I indulged in some retail therapy at the local boutiques.

Shopping at the Pike Outlets

I couldn’t resist a visit to the Pike Outlets, where I found amazing deals on clothing. The 10.25% sales tax was a reminder to carefully consider my purchases, but with the discounts available, I walked away with several great items without breaking the bank.

Dining at Local Restaurants

Dining out is another area where sales tax comes into play. Enjoying a delicious meal at a seaside restaurant, my bill included the sales tax, which I had already calculated in my budget. It’s always a good idea to research menus and check for any service fees beforehand.

Pros and Cons of the Sales Tax Rate in Long Beach

Pros

- Supports public services and infrastructure in Long Beach.

- Helps fund local attractions, parks, and community events.

- Allows for diverse shopping and dining options in the city.

Cons

- Increases overall spending for travelers.

- Potentially higher prices compared to neighboring cities.

- Can be a deterrent for budget-conscious travelers.

FAQs About Sales Tax in Long Beach, CA

What is the sales tax rate for restaurants in Long Beach?

The sales tax rate for restaurants in Long Beach is the same as the standard sales tax rate, which is currently 10.25%.

Are there any tax exemptions for tourists?

California does not offer specific tax exemptions for tourists, but always check for any promotions or tax-free events.

How do I find out about new sales tax rates?

Updates on sales tax are typically provided by state tax authorities and local government websites. It’s beneficial to check these resources before your trip.

Final Thoughts

Understanding the sales tax rate in Long Beach, CA, is essential for planning a budget-friendly trip. Whether you’re shopping at the Pike Outlets or dining at one of the local eateries, being aware of the sales tax will help you manage your expenses effectively. With the beautiful attractions and rich culture Long Beach has to offer, you can enjoy your stay without worrying too much about the financial impact.