Welcome to your ultimate guide to understanding the sales tax rate in Long Beach, CA—a vibrant coastal city that attracts millions of visitors each year. Whether you’re lounging on the beach, exploring the Aquarium of the Pacific, or sampling delicious cuisine at local eateries, knowing the sales tax rate can help you budget better for your trip.

The Basics of Sales Tax in Long Beach, CA

Sales tax is a significant factor to consider when traveling, especially in places like California, where the rates can vary by location. In this section, we will break down what the sales tax rate in Long Beach looks like and how it compares to other cities in California.

Current Sales Tax Rate in Long Beach

As of 2023, the total sales tax rate in Long Beach, CA, is 10.25%. This comprises different components, which we will explore in greater detail below.

- State Sales Tax: 7.25%

- County Sales Tax: 2%

- City Sales Tax: 1%

How Sales Tax Affects Your Travel Budget

Understanding sales tax is crucial for managing your travel budget effectively. Sales tax applies to most goods and services, including accommodations, dining, and shopping.

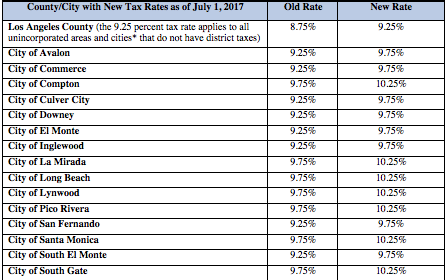

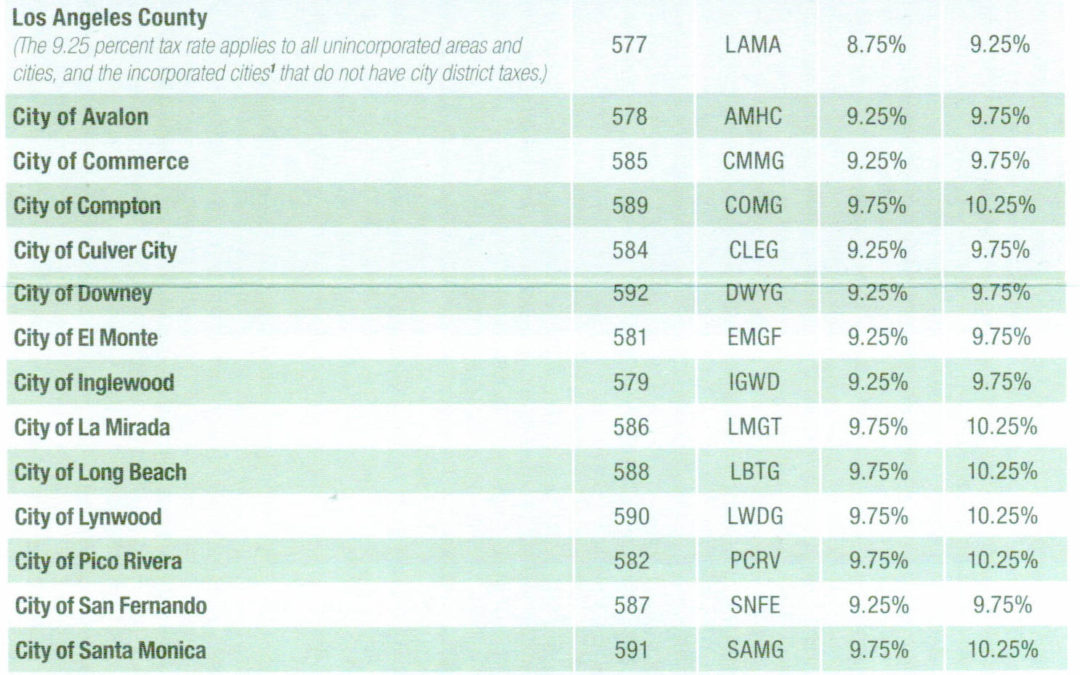

Comparative Sales Tax Rates in California Cities

| City | Sales Tax Rate |

|---|---|

| Long Beach | 10.25% |

| Los Angeles | 9.5% |

| San Diego | 7.75% |

| San Francisco | 8.5% |

Personal Experiences in Long Beach

During my last visit to Long Beach, I had the chance to savor some delicious food at local restaurants, shop at unique boutiques, and stay in a cozy hotel by the beach. Here’s how the sales tax affected my overall spending:

Dining Expenses

At a quaint seafood restaurant, I enjoyed a lovely meal that cost $50. With the sales tax, the total ended up being:

Total Cost: $50 + ($50 * 10.25%) = $55.13

This experience made it clear that even a modest meal can add up when you factor in the sales tax!

Shopping Adventures

Later, I explored local shops and found a unique handcrafted souvenir for $30. Here’s how the sales tax impacted that purchase:

Total Cost: $30 + ($30 * 10.25%) = $33.08

It was a lovely reminder of my trip, but I had to keep in mind that the price on the tag wasn’t the final price!

Tips for Budgeting with Sales Tax in Mind

To help you manage your budget while traveling in Long Beach, here are some helpful tips:

1. Always Check for Sales Tax

Before making a purchase, always check to see if the price includes sales tax. Many stores, especially restaurants, will include it in the final bill, but not all will.

2. Use Sales Tax Calculators

Online sales tax calculators can help you estimate your total costs more accurately. Use them to plan your expenses ahead of time.

3. Factor Tax into Your Travel Budget

When budgeting for your trip, include an estimate for sales tax based on your expected spending. This will help prevent unexpected financial surprises!

Destination Highlights in Long Beach

Aside from understanding sales tax, you won’t want to miss these wonderful attractions during your stay in Long Beach:

The Queen Mary

This historic ocean liner turned hotel offers tours and dining options that are unique to Long Beach. The sales tax applies to ticket sales, so budget accordingly.

Aquarium of the Pacific

With a variety of aquatic exhibits and interactive activities, the aquarium is a must-visit for families. Ticket prices also include sales tax, so check their website for current rates.

Long Beach Museum of Art

The museum features a fantastic collection of art and beautiful ocean views. Admission prices will also reflect the sales tax, so keep that in mind!

Pros and Cons of Sales Tax in Long Beach

Pros

- Helps fund local infrastructure and community services.

- Supports various attractions and events in the area.

Cons

- Can significantly increase your total travel expenses.

- May catch tourists off guard if they’re not prepared for the rates.

FAQs About Sales Tax in Long Beach, CA

What is the sales tax rate in Long Beach, CA?

The current sales tax rate in Long Beach, CA, is 10.25%.

Are there any exemptions from sales tax in California?

Some items like groceries, prescription medications, and certain services are generally exempt from sales tax.

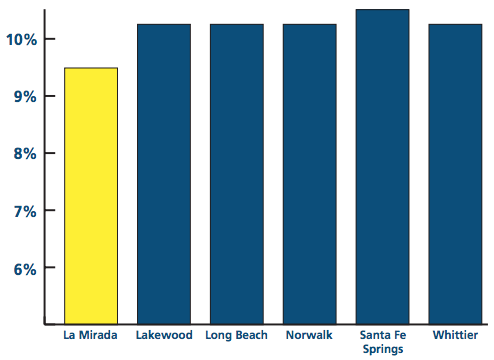

How does the sales tax rate compare to other cities in California?

Long Beach has a higher sales tax rate than cities like San Diego (7.75%) but lower than Los Angeles (9.5%).