Introduction: Why Sales Tax Matters for Travelers

As a frequent traveler, I’ve learned that every dollar counts when exploring new places. One aspect that often gets overlooked is the local sales tax. When visiting Palm Beach County, understanding the local sales tax rate can help you budget better for your trip. In this article, we’ll dive deep into what the sales tax rate is in Palm Beach County, how it compares to other areas, and practical tips to navigate it while traveling.

What is Sales Tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. When you purchase an item, the seller adds the sales tax to the price, and this tax revenue goes towards funding various public services.

Current Sales Tax Rate in Palm Beach County

As of October 2023, the sales tax rate in Palm Beach County is 7%. This includes the state sales tax rate of 6% and the local tax of 1%. Here’s a simple breakdown:

- State Sales Tax: 6%

- Local Sales Tax: 1%

- Total Sales Tax Rate: 7%

How Sales Tax Affects Travelers

Budgeting for Your Trip

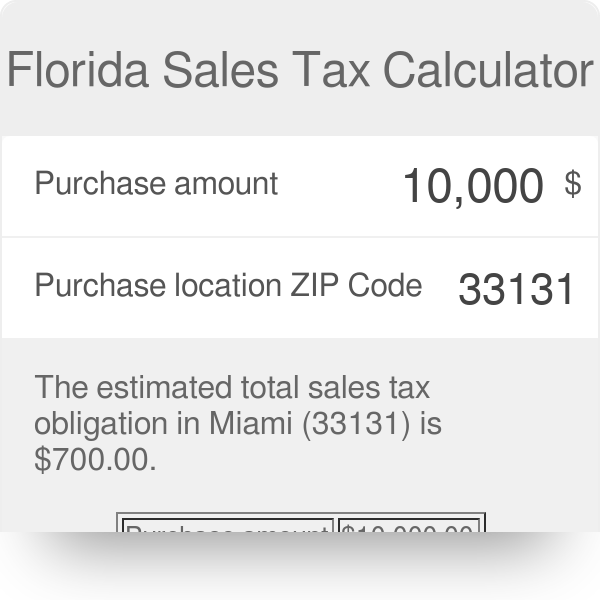

When planning your trip to Palm Beach County, it’s essential to factor in the sales tax for your budget. For instance, if you purchase a souvenir for $50, the total amount you’ll pay including sales tax will be:

Calculation: $50 + ($50 x 0.07) = $53.50

Shopping and Dining

Whether you’re shopping for beachwear or dining at a local restaurant, keep in mind that the sales tax will be added to your final bill. This can add up quickly, so it’s a good idea to have a clear idea of your budget beforehand.

Sales Tax Comparisons: Palm Beach County vs. Other Regions

Sales Tax Rates Across Florida

| County | Sales Tax Rate |

|---|---|

| Miami-Dade County | 7% |

| Broward County | 7% |

| Orlando (Orange County) | 6.5% |

| Tampa (Hillsborough County) | 8% |

| Palm Beach County | 7% |

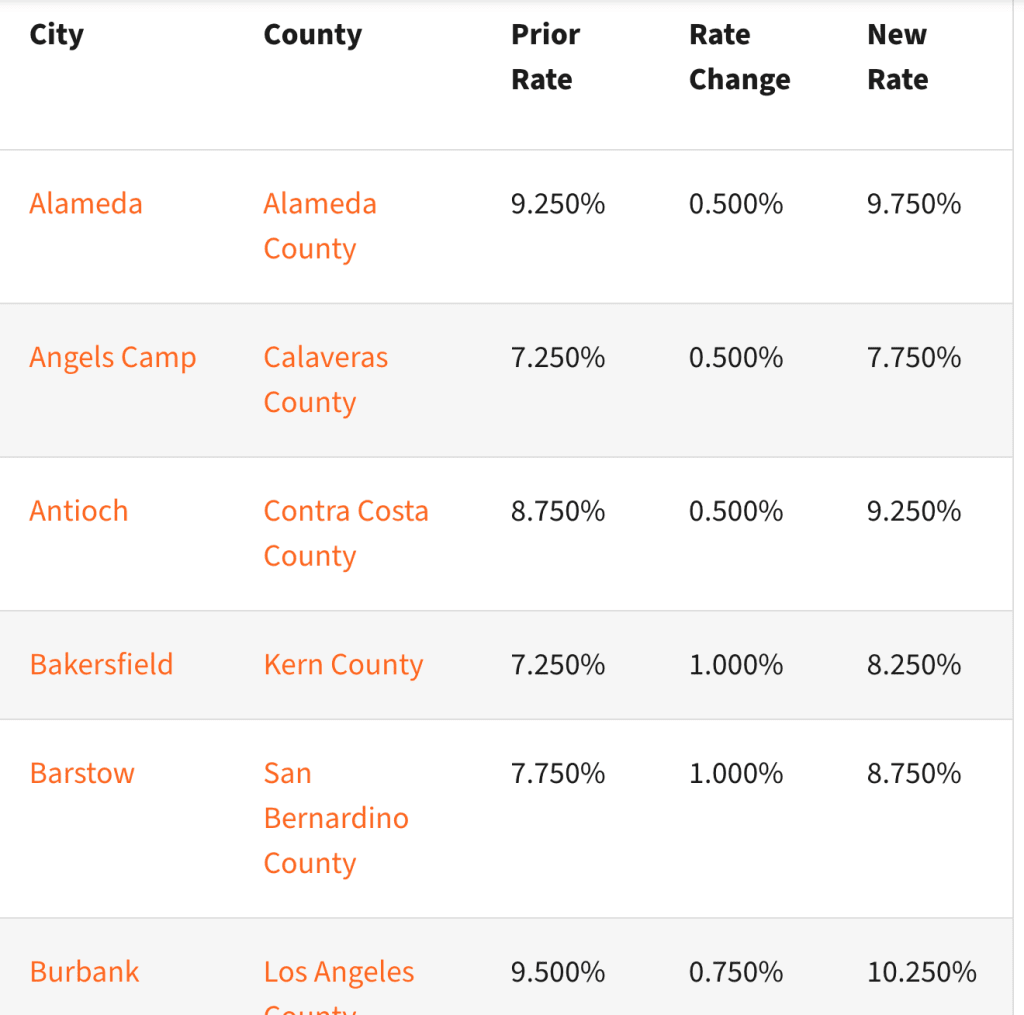

How Palm Beach County Compares Nationally

While Palm Beach County’s 7% sales tax rate is relatively typical for Florida, it’s essential to compare this to national averages. The average sales tax rate in the United States hovers around 6.5%, meaning Palm Beach is slightly above average. However, in high-tourism areas, this rate can be as high as 9% or more.

Tips for Dealing with Sales Tax in Palm Beach County

1. Always Check Prices Before Buying

Many stores list their prices without sales tax included. Make it a habit to verify what the final price will be before making a purchase.

2. Watch Out for Hidden Fees

Some places may add additional fees. Always ask about the total cost, including taxes and tips, before committing to services or dining.

3. Use Cash When Possible

Using cash can sometimes help you avoid extra fees that come with card transactions. Plus, it’s easier to keep track of your expenses without the influence of credit card spending limits.

Destination Highlights: Shopping and Dining in Palm Beach County

Top Shopping Destinations

1. Worth Avenue

Known as the “Rodeo Drive of the East,” Worth Avenue is a luxury shopping district where high-end brands come alive. Remember to include the sales tax in your luxury purchases!

2. The Gardens Mall

This popular mall features a variety of stores from chic boutiques to big-name brands. It’s a great place to shop if you’re looking for variety but don’t forget about the taxes!

Best Dining Experiences

1. Buccan

This upscale eatery offers a trendy dining experience with an eclectic menu. Expect to pay extra on your bill for sales tax and tips!

2. The Breakers

The historic hotel offers several dining venues worth exploring – just be prepared for added costs from sales tax.

Pros and Cons of Traveling to Palm Beach County

Pros

- Beautiful beaches and outdoor activities

- Rich cultural experiences and events

- Luxurious shopping and dining options

Cons

- Higher cost of living reflected in prices

- Sales taxes can add up quickly

- Traffic can be challenging, especially in tourist areas

Frequently Asked Questions

1. What is the sales tax rate in Palm Beach County?

The current sales tax rate in Palm Beach County is 7%, which includes a 6% state tax and a 1% local tax.

2. Are there any items exempt from sales tax in Florida?

Yes, certain items such as groceries, prescription medications, and some medical supplies are exempt from sales tax in Florida.

3. How can I avoid paying sales tax on my vacation purchases?

While sales tax is generally unavoidable in most purchases, consider shopping during tax-free weekends for specific items, like clothing or school supplies.

4. Is the sales tax rate uniform across all Florida counties?

No, sales tax rates can vary by county. Palm Beach County’s rate is 7%, while some areas may have higher rates of up to 8% or more.