Traveling is one of life’s greatest pleasures, allowing us to explore new cultures, savor delicious cuisines, and create unforgettable memories. But did you know that credit unions can play a significant role in making your travel experiences even better? In this comprehensive guide, we’ll explore the advantages of credit union travel options, share personal insights, and provide tips to maximize your journeys. Whether you’re a frequent flyer or planning your first getaway, this article will help you navigate through the world of credit union travel.

Understanding Credit Unions and Their Travel Services

Credit unions are member-owned financial cooperatives that offer various services, including savings accounts, loans, and unique travel opportunities. Unlike traditional banks, credit unions focus on serving their members, which often leads to lower fees and better interest rates.

What Makes Credit Unions Different?

- Member-oriented: Credit unions prioritize their members over profits.

- Lower Fees: Many credit unions offer lower fees compared to traditional banks.

- Community Focused: Many credit unions support local businesses and initiatives.

Types of Travel Services Offered by Credit Unions

From travel loans to exclusive member discounts, credit unions often provide a variety of travel services, including:

- Travel Rewards Credit Cards

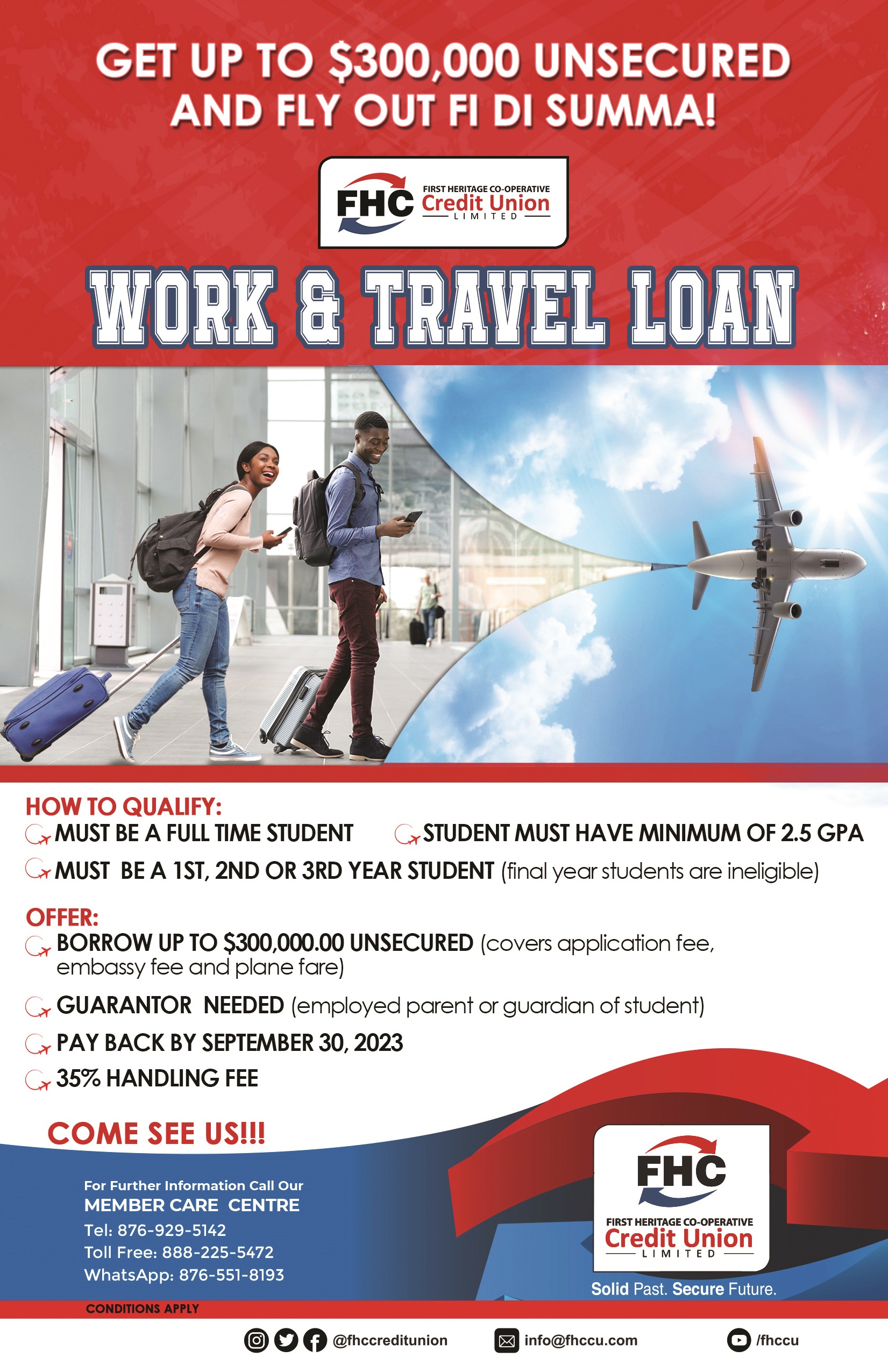

- Personal Travel Loans

- Discounted Travel Packages

- Travel Insurance Options

- Concierge Services for Trip Planning

Personal Experiences: Traveling with Credit Union Benefits

As someone who has traveled extensively, my credit union’s offerings have significantly enhanced my travel journeys. Last summer, I decided to visit Europe, and the travel rewards credit card from my credit union made it affordable. With points accumulated from everyday purchases, I managed to book flights and accommodations at a lower cost.

How My Credit Union Travel Loan Saved the Day

When my family planned a trip to Hawaii, we found the cost overwhelming. Thankfully, my credit union offered a low-interest travel loan that allowed us to embrace the beauty of the islands without breaking the bank. It was easy to apply and get approved, and we were able to start planning our dream vacation right away!

Pros and Cons of Using Credit Unions for Travel

Pros

- Lower Interest Rates: Credit unions typically offer lower rates on loans and credit cards.

- Exclusive Deals: Access to member-only travel discounts and packages.

- Responsive Customer Service: Credit unions tend to have more personalized service, making it easier to resolve issues.

Cons

- Limited Geographic Reach: Some credit unions may have fewer ATMs or branches in certain areas.

- Membership Requirements: Joining a credit union usually requires meeting specific eligibility criteria.

- Fewer High-Tech Features: Some smaller credit unions may lack advanced digital banking tools compared to larger banks.

Comparing Credit Union Travel Options: A Closer Look

Travel Rewards Credit Cards

Many credit unions offer travel rewards credit cards that allow you to earn points or miles for every dollar spent. Here’s a comparison of some popular options:

| Credit Union | Card Name | Annual Fee | Rewards Rate | Sign-Up Bonus |

|---|---|---|---|---|

| First Tech FCU | Visa Signature Travel Rewards | None | 3x Points on Travel | 30,000 Points after $3,000 spend |

| Wings Financial | Wings Travel Rewards Card | None | 2x Points on Dining and Travel | 25,000 Points after $1,500 spend |

| Alliant Credit Union | Alliant Visa Signature | $99 (waived if spending exceeds $10,000) | 2.5x Points on All Purchases | 75,000 Points after $3,000 spend |

Travel Insurance Options

Credit unions often provide their members with comprehensive travel insurance at competitive rates. Here’s a breakdown of some popular coverage options available:

| Insurance Provider | Coverage Type | Price per Trip | Benefits |

|---|---|---|---|

| CU Travel Insurance | Comprehensive Travel Insurance | $79 | Covers Trip Cancellation, Medical Emergencies |

| InsureMyTrip | Basic Travel Insurance | $50 | Covers Trip Interruption and Baggage Loss |

| World Nomads | Adventure Travel Insurance | $89 | Covers Extreme Sports, Medical Emergencies |

Top Travel Tips for Credit Union Members

1. Maximize Your Rewards Points

To make the most of your travel rewards credit card, consider using your card for everyday purchases. This way, you can accumulate points faster!

2. Add Authorized Users

If your credit union allows it, add family members as authorized users on your travel card. This can help you rack up points even quicker while still maintaining control over the account.

3. Plan and Book in Advance

Credit unions often provide exclusive booking windows for members. Make sure to plan your travel well in advance to take advantage of these benefits.

4. Utilize Travel Assistance Services

Take full advantage of any travel assistance services your credit union may offer, such as trip planning or concierge services. They can help you make informed decisions and ensure your trip goes smoothly.

Destination Highlights: Traveling with Credit Union Benefits

Certain destinations offer unique opportunities that can be enhanced with credit union perks. Here are a few highlights from my travels:

1. Exploring the Majestic Mountains of Colorado

Thanks to my credit union’s travel rewards program, I was able to experience the breathtaking beauty of Colorado’s Rocky Mountains. With discounted accommodations arranged through my credit union partner, I hiked, skied, and soaked in stunning views at a fraction of the cost.

2. Cultural Delights in New Orleans

New Orleans is a destination filled with rich history and delicious cuisine. Utilizing travel loans, I secured an incredible jazz-themed hotel stay while enjoying local delicacies. The member discounts made my culinary experience even more delightful!

3. Exotic Beaches of Hawaii

During my Hawaiian getaway, the travel insurance I obtained through my credit union gave me peace of mind. From snorkeling with turtles to experiencing a traditional luau, my trip was seamless and unforgettable!

FAQs About Credit Union Travel

What are the benefits of using a credit union for travel-related needs?

Credit unions often provide lower interest rates on travel loans, exclusive discounts on travel packages, and rewards points on credit cards, all of which can make your trip more affordable.

Can I get a travel loan from any credit union?

Not all credit unions offer travel loans, but many do. Check with your local credit union to see what travel financing options they have available.

How do credit union travel rewards work?

Credit union travel rewards typically work through a points system. For every dollar spent on eligible purchases, you earn points that can be redeemed for flights, hotels, or other travel-related expenses.

Is travel insurance worth it?

Travel insurance can protect you from unexpected costs, such as trip cancellations or medical emergencies. Given the unpredictability of travel, it’s often a worthwhile investment.

Conclusion: Make the Most of Your Credit Union Travel Experience

Credit unions offer numerous benefits for savvy travelers looking to maximize their journeys. From travel rewards credit cards to low-interest loans, the value is undeniable. By leveraging these resources, you can explore the world while saving money and enjoying peace of mind.

Whether you’re dreaming of tropical beaches, mountain escapades, or cultural expeditions, your credit union can be a fantastic partner in your travel adventures. Happy travels!