Understanding the Importance of Insurance in Long Beach

Living in Long Beach, California, is a vibrant and beautiful experience, with stunning beaches and a bustling metropolitan feel. However, like any city, it comes with its own set of risks and uncertainties. This is where insurance plays a vital role in protecting you, your family, and your assets. In this article, we will explore the various types of insurance available in Long Beach, offering insights into how to choose the best policies for your individual needs.

Types of Insurance Options Available in Long Beach

Insurance covers a wide array of areas. Below are the main types of insurance services available in Long Beach, California:

1. Health Insurance

Health insurance is crucial for securing access to medical care without debilitating financial burden. Residents of Long Beach have various options:

- Employer-sponsored plans

- Individual market plans through Covered California

- Medi-Cal for low-income individuals

2. Auto Insurance

California mandates auto insurance for all drivers. In Long Beach, you can find numerous providers offering varying coverage options, which typically include:

- Liability coverage

- Collision coverage

- Comprehensive coverage

3. Homeowners Insurance

Due to the risk of natural disasters, particularly wildfires and earthquakes, homeowners insurance is a must for Long Beach residents. Key elements in these policies often comprise:

- Dwelling coverage

- Personal property coverage

- Liability protection

4. Renters Insurance

If you rent in Long Beach, renters insurance is critical. It provides coverage for your personal belongings and liability.

5. Life Insurance

Life insurance offers financial security for your loved ones after you pass away. It’s vital for anyone looking to secure their family’s future.

Comparing Insurance Providers in Long Beach

Choosing the right insurance provider can be daunting. Below is a comparison table of some prominent insurance providers in Long Beach:

| Insurance Provider | Types of Insurance Offered | Average Customer Rating | Year Established |

|---|---|---|---|

| State Farm | Auto, Home, Life, Health | 4.5/5 | 1922 |

| Allstate | Auto, Home, Life, Renters | 4.2/5 | 1931 |

| Farmers Insurance | Auto, Home, Life | 4.0/5 | 1928 |

| Progressive | Auto, Home, Renters | 4.3/5 | 1937 |

| Blue Shield of California | Health | 4.1/5 | 1939 |

Factors to Consider When Choosing Insurance in Long Beach

Making an informed choice involves considering various factors:

1. Coverage Needs

Assess your personal and family needs, including health, vehicle, and property.

2. Budget

Determine what you can afford monthly, and remember that cheaper isn’t always better if the coverage is insufficient.

3. Provider Reputation

Research customer reviews and ratings. The insurance provider’s response to claims should also be evaluated.

4. Local Presence

Having a local agent can be beneficial for personalized support and service.

5. Discounts

Look for available discounts, like bundling home and auto insurance.

Pros and Cons of Different Insurance Types in Long Beach

Here’s a breakdown of the advantages and disadvantages of various types of insurance:

Health Insurance

| Pros | Cons |

|---|---|

| Access to essential healthcare services | Premiums can be high |

| Preventative care often included | Out-of-pocket costs can vary |

Auto Insurance

| Pros | Cons |

|---|---|

| Legal requirement in California | Can be expensive based on driving record |

| Coverage for damages and liabilities | Complex policy structures |

Homeowners Insurance

| Pros | Cons |

|---|---|

| Protection against natural disasters | May not cover all types of damage |

| Personal property covered | Costs can be high in high-risk areas |

Local Long Beach Insurance Providers and Their Services

Exploring local providers can yield better understanding and support. Here are some popular insurance agencies in Long Beach:

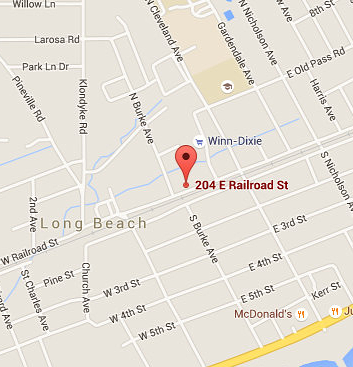

1. Long Beach Insurance Agency

Specializes in affordable auto and homeowners insurance. Known for personalized customer service.

2. The J. Garcia Insurance Agency

Great for small businesses looking for commercial insurance options.

3. Pacific Premier Insurance

Offers a variety of insurance products, including life and health insurance.

Understanding the Legal Aspects of Insurance in California

Insurance in California is also governed by certain laws and regulations:

1. Proposition 103

This law requires insurance companies to justify any rate increases and provides consumers with rights regarding their insurance policies.

2. The California Department of Insurance

This department regulates insurance providers, ensuring they adhere to the law and providing consumer assistance.

3. Coverage Minimums

California mandates minimum coverage for auto insurance, including liability limits that drivers must meet.

Tips for Navigating Insurance Claims in Long Beach

Filing an insurance claim can be overwhelming. Here are some steps to make the process smoother:

1. Document Everything

Take photos and notes of any damage or incident to support your claim.

2. Know Your Policy

Understand your coverage and exclusions before filing a claim.

3. Report Promptly

File your claim as soon as possible to avoid delays.

4. Communicate Openly

Stay in touch with your claims adjuster for updates and follow-up questions.

FAQs about USA Insurance in Long Beach

1. What types of insurance are mandatory in California?

Auto insurance is mandatory in California, along with workers’ compensation for employers.

2. How can I lower my insurance premiums?

Consider bundling policies, maintaining a good credit score, and increasing deductibles.

3. Are there specific insurance companies recommended for Long Beach residents?

Providers like State Farm, Allstate, and Farmers have strong reputations and comprehensive offerings for Long Beach residents.

4. What should I look for in an insurance policy?

Focus on coverage limits, deductibles, exclusions, and customer service ratings.

5. How do claims differ among insurance providers?

Claims processes can vary; check reviews and ask about experiences to understand how each provider handles claims.